Small Employers Relief

-

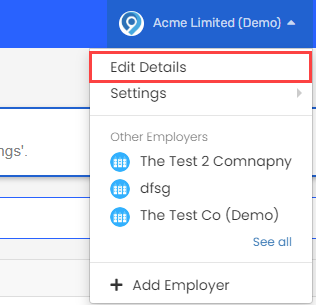

Select the required employer.

-

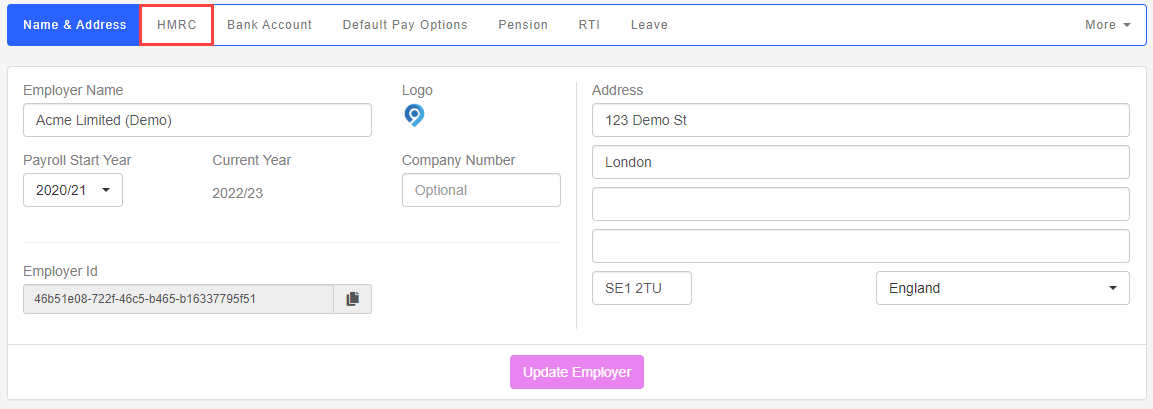

Go to your company name > Edit Details.

-

-

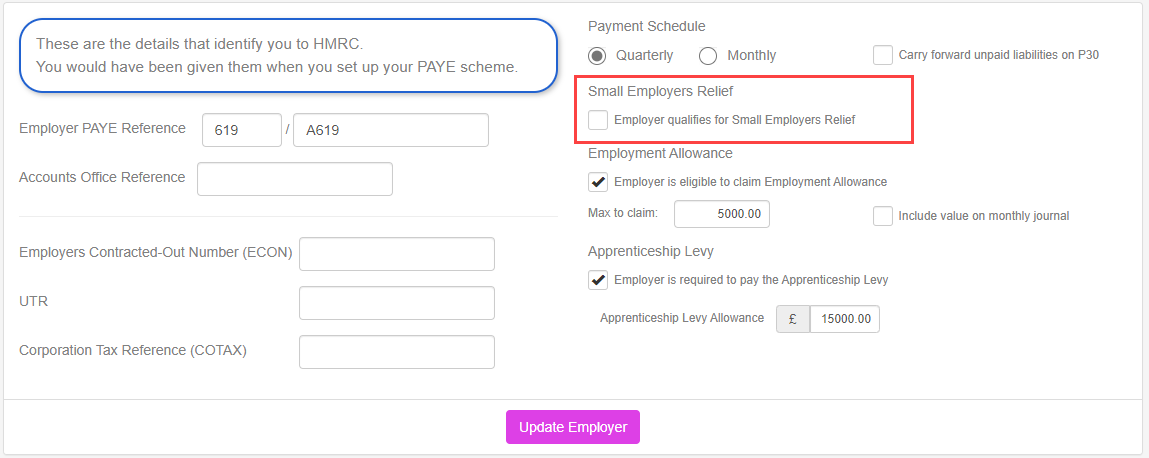

Select Small Employers Relief.

-

Select Update Employer.

Good to know...

-

GOV.UK Guide: Get financial help with statutory pay. External website

-

Small employers can claim 100% plus an additional 3% if your Class 1 Employees under State Pension age earning more than the threshold a week from one job - they’re automatically deducted by the employer. National Insurance A system of contributions paid by workers and employers in the UK, which funds various state benefits, such as the State Pension and Jobseeker's Allowance. (ignoring any reductions like Employment Allowance A scheme where a business can claim a reduction in the amount of employer's National Insurance contributions (NICs) they have to pay.) is below the threshold.

-

Other employers can claim 92%.

-

You get no relief for Sick Pay (SSP Statutory sick pay refers to the pay an employer must give you if you’re too ill to work. It’s paid to you by your employer for up to 28 weeks, based on certain eligibility criteria - the cost of SSP is no longer able to be recovered - SSP is no longer reported to HMRC on your EPS submissions).

-

The amount is deducted from the Class 1 National Insurance payment made to HMRC. You pay the reduced amount.

-

You must send an Employer Payment Summary (EPS Employer Payment Summary is an RTI online submission sent monthly if, you are reclaiming statutory payments, claiming Employment Allowance (EA is only reported once per tax year), reporting Construction Industry Scheme (CIS) deductions or reporting how much Apprenticeship Levy is due. The EPS is also used to report if no employees will be paid for a whole tax month or longer.) to HMRC for them to record the claim, otherwise they will class it as an underpayment.