Importing Permanent additions and deductions

You can import permanent additions and deductions to create or update pay lines within an employee’s record.

Download the import template

-

Open the required company.

-

Go to Reports and select Employee.

-

Select Employee Payments.

-

Select the required Schedule and any Included Pay Codes you want to make permanent changes to.

Selecting pay codes includes the Unique Identifier, this is required to update or replace existing paylines.

-

Select Download As.. and select CSV.

Import payments and deductions

-

Select the required company.

-

Select Employees.

-

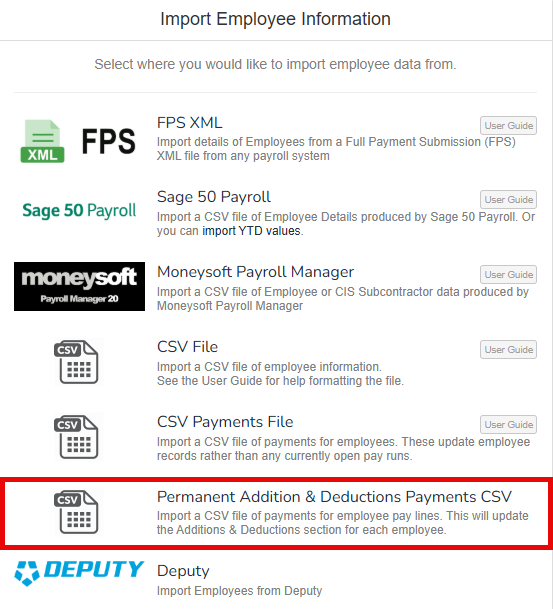

Go to Import and select Permanent Addition & Deductions Payments CSV.

-

Select the required file.

Good to know...

-

When importing the file, the payroll will apply rules for the payment or deduction:

Create a New Pay Line

If no Unique Identifier is provided, the system will create a new pay line for the employee.Update an Existing Pay Line

If the Unique Identifier and Effective Date match an existing pay line, it will be updated with the new values from your file.Replace an Existing Pay Line

If the Unique Identifier exists but the Effective Date is different, the original pay line will be replaced.