Benefit warnings and information

Find out about benefits.

-

Open the required company.

-

Select Employees then select the required employee.

-

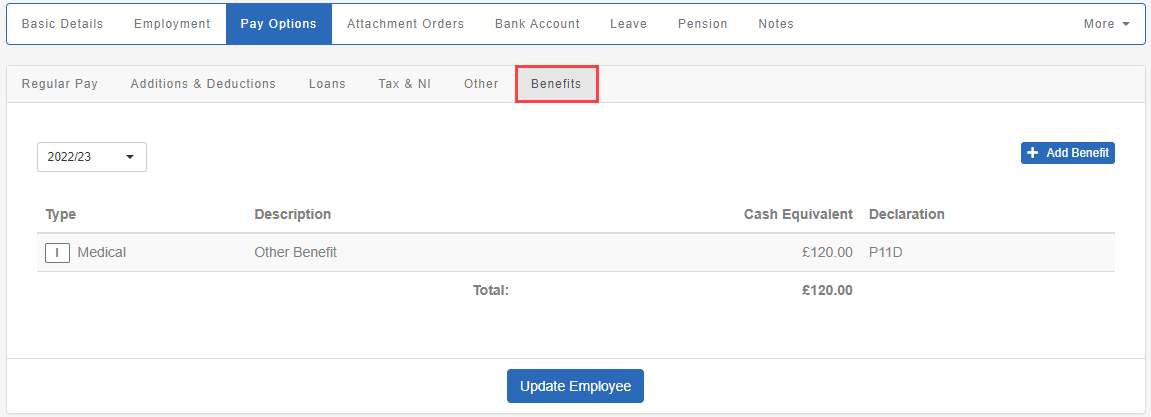

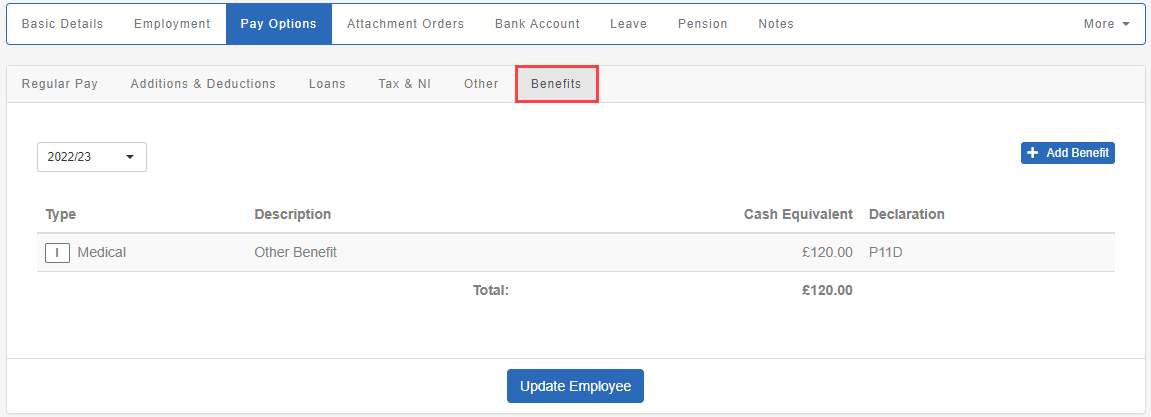

Select Pay Options then Benefits.

-

Select the required Car benefit and make the changes.

-

Select Update Employee.

-

Open the required company.

-

Select Employees then select the required employee.

-

Select Pay Options then Benefits.

-

Select the required benefit and make the changes.

-

Select Update Employee.

Staffology Payroll calculated benefits based on an annual amount divided by the number of periods paid. During the migration, the amount has been multiplied by the pay frequency to calculate an annual amount.

Living Accommodation and / or loans can only be submitted via a P11DP11D is used by employers to report end-of-year expenses and benefits for employees who earned more than £8,500. Employees who receive Benefits in Kind (BiK) are entitled to an end of year report that outlines their benefits and expenses in the tax year.. They can't be included as an in payrolling benefit.