P30 report

Generate a P30 to summarise your HMRC liabilities

-

Open the required company.

-

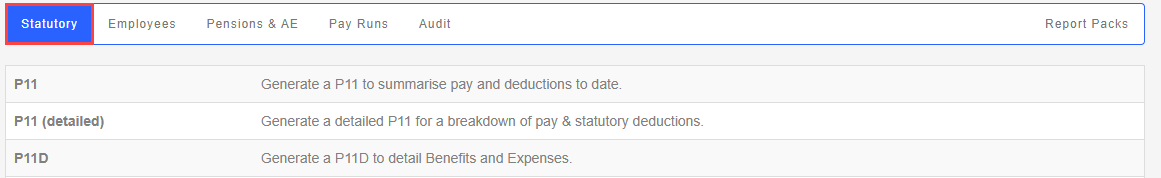

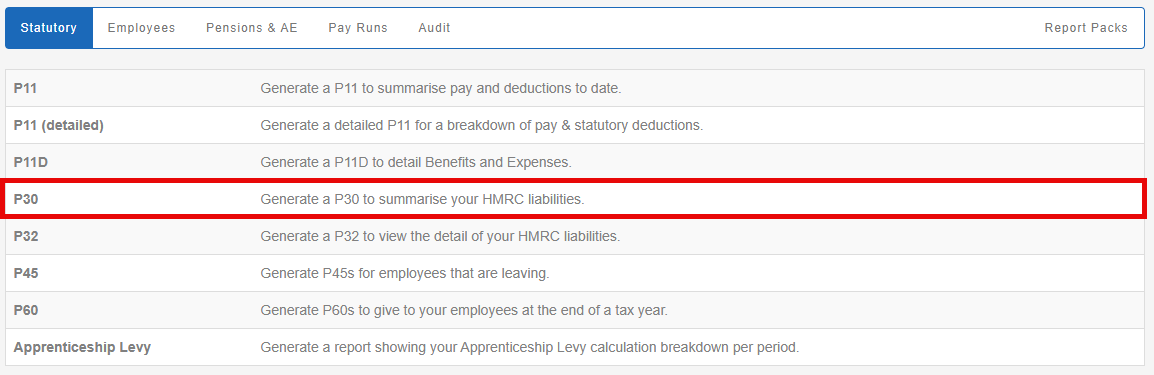

Go to Reports.

-

Select Statutory.

-

Select P30 Month end summary report, highlights the amount to be paid to the HMRC for that tax month..

-

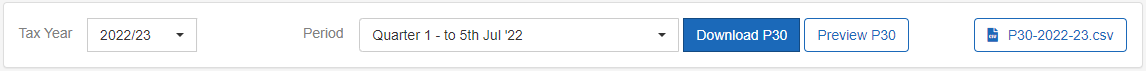

Select a Tax Year.

-

Select a Period.

-

Select Download P30 (if required). This will produce a view of the selected period (quarter).

-

Alternately, select the P30-2022-23.csv to view a full year containing all 4 quarters.

-

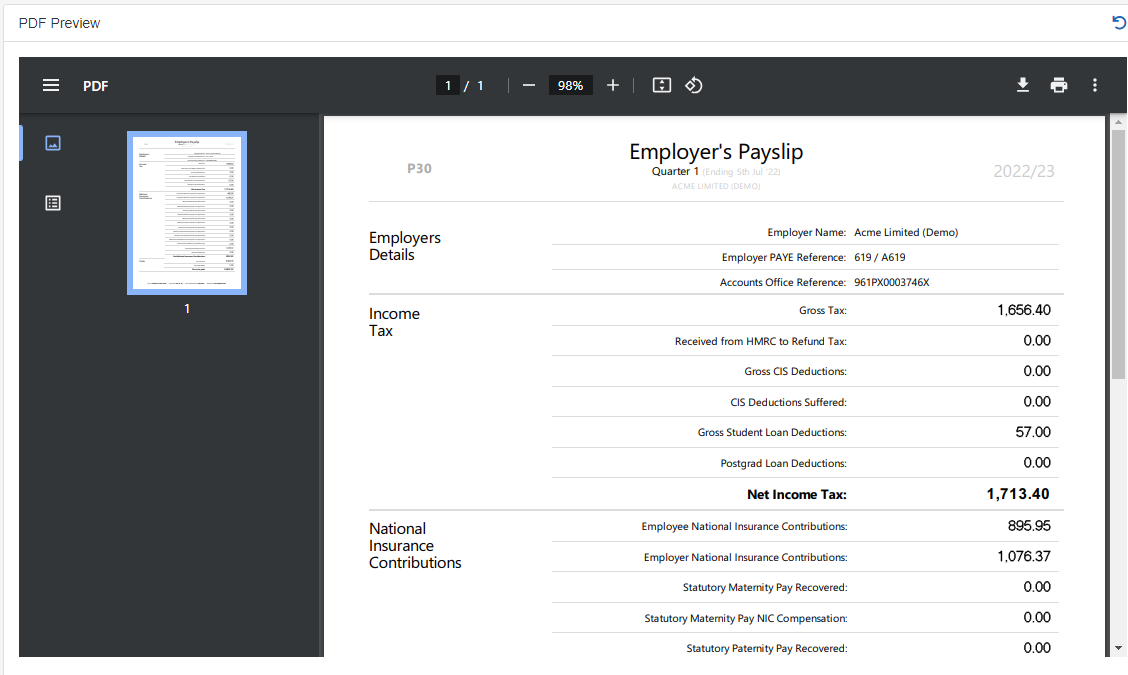

Select Preview P30 (if required).

Good to know...

The P30-2022-23.csv will display the tax year you are in. For the 2023-24 tax year, P30-2023-24.csv would be displayed.

Example...

-

Download P30. PDF

-

P30-2022-23.csv. CSV