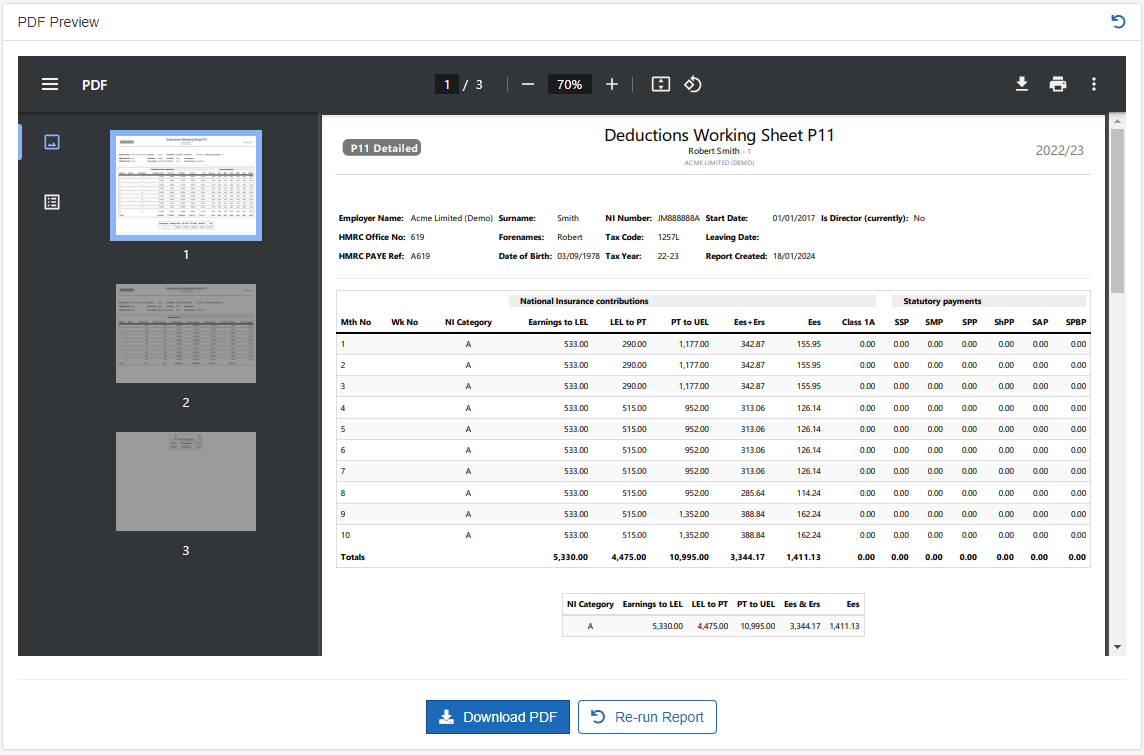

P11 (detailed)

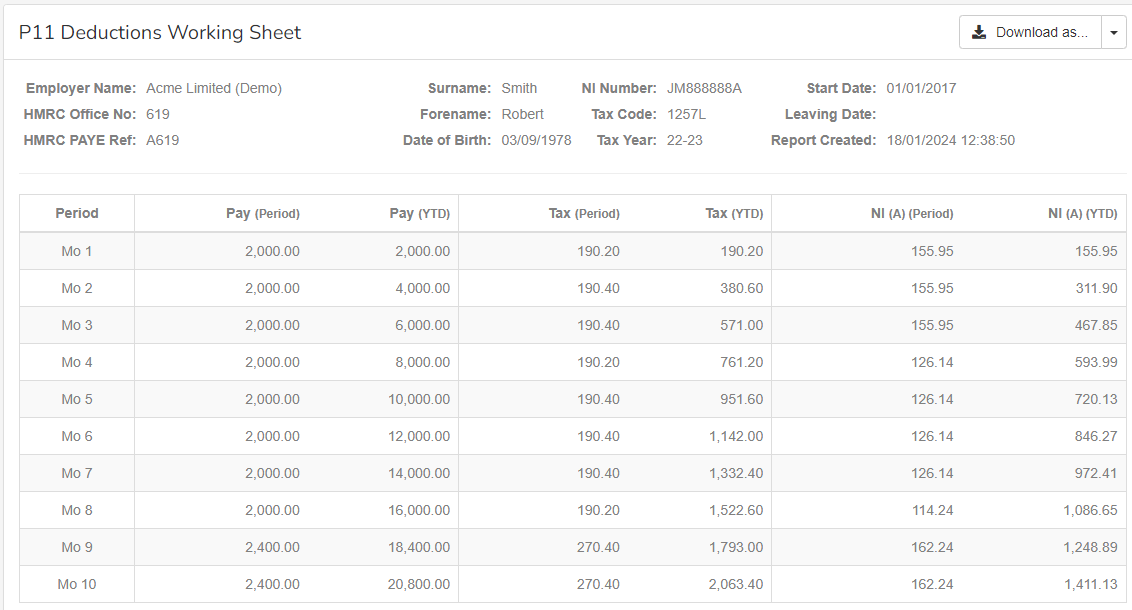

The P11 (detailed) report displays payments and deductions you make to employees throughout the tax year and is a useful tool for reconciliation purposes, or for investigating any issues.

-

Open the required company.

-

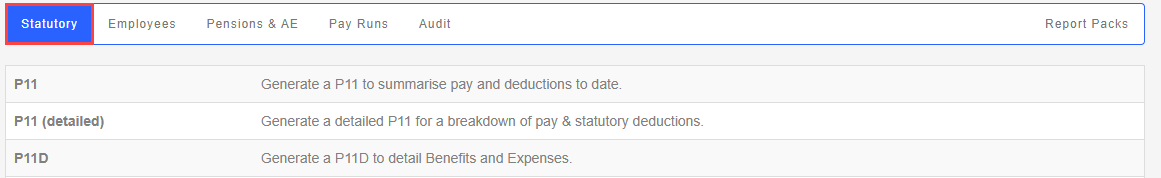

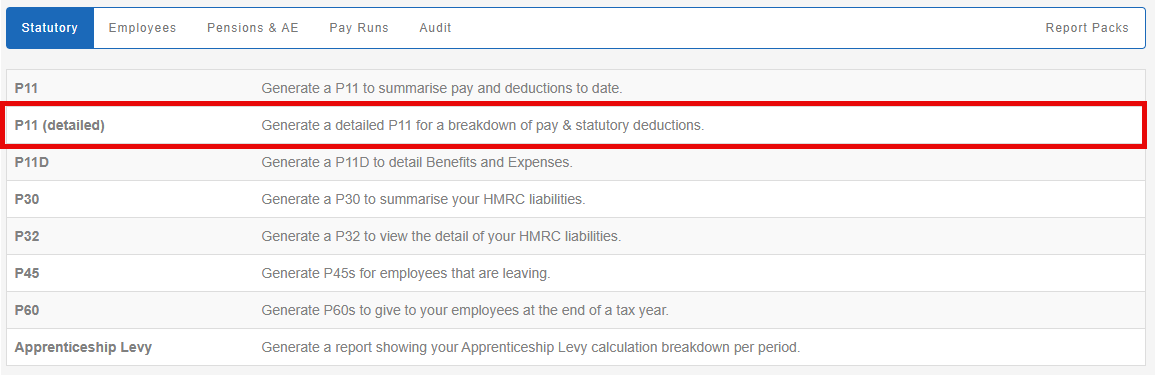

Go to Reports.

-

Select Statutory.

-

-

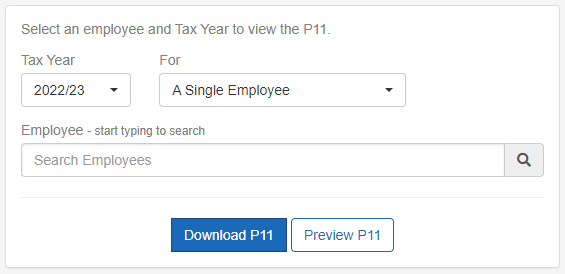

Choose the Tax Year.

-

Choose a For option:

-

If A Single Employeeis chosen:

-

Enter employee name in Search Employees.

-

Select employee from offered list of results.

-

-

If All Employeesis chosen, no further options are required.

-

-

Select Preview P11.

-

Select Download P11 (if required).

Example...

-

Select Preview P11 (if required).