Gender pay gap

Generate a gender pay gap report showing the information required to prepare your data for HMRC.

Before you begin, you need a pay code set for ordinary pay and bonus pay. Find out more

-

Open the required company.

-

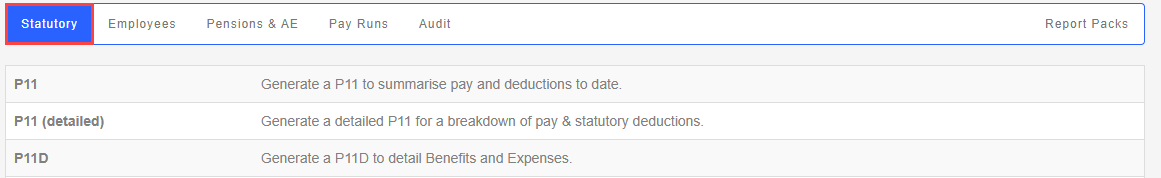

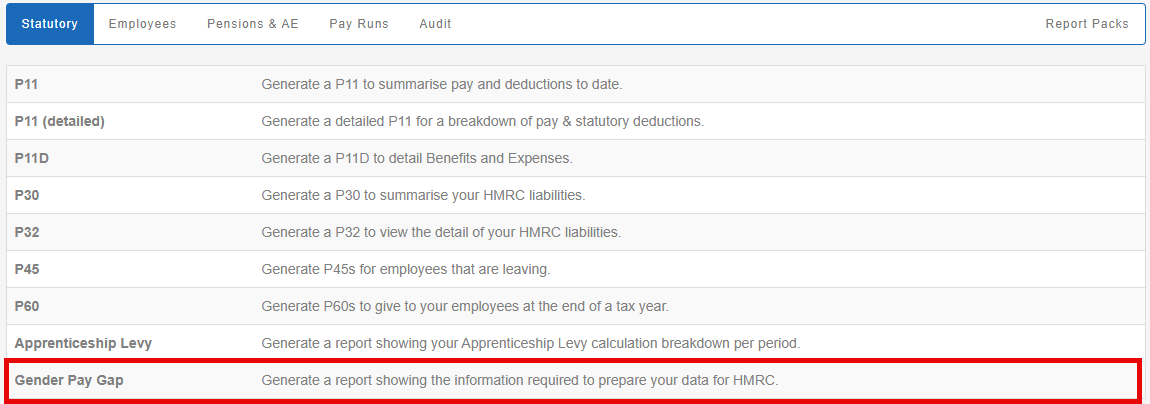

Go to Reports.

-

Select Statutory.

-

Select Gender Pay Gap.

-

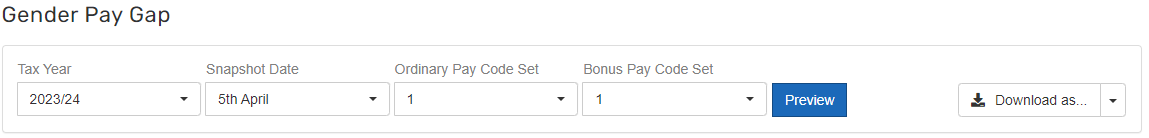

Choose the Tax Year.

-

Select the Snapshot Date.

-

31st March: The last pay period that includes the pay day of 31st March.

-

5th April: Users the monthly pay period for April. This is usually 1st to 30th April.

If the employee is on a zero or variable hours contract, the employee working pattern must be set as 0.

-

-

Choose the Ordinary Pay Code Set and Bonus Pay Code Set.

Before you begin, you need a pay code set for ordinary pay and bonus pay. Find out more

-

Select Preview.

Information on how we calculate for employees with variable hours.

Find out more

Select Download as.. (if required).

-

Download as PDF.

-

Download as CSV.

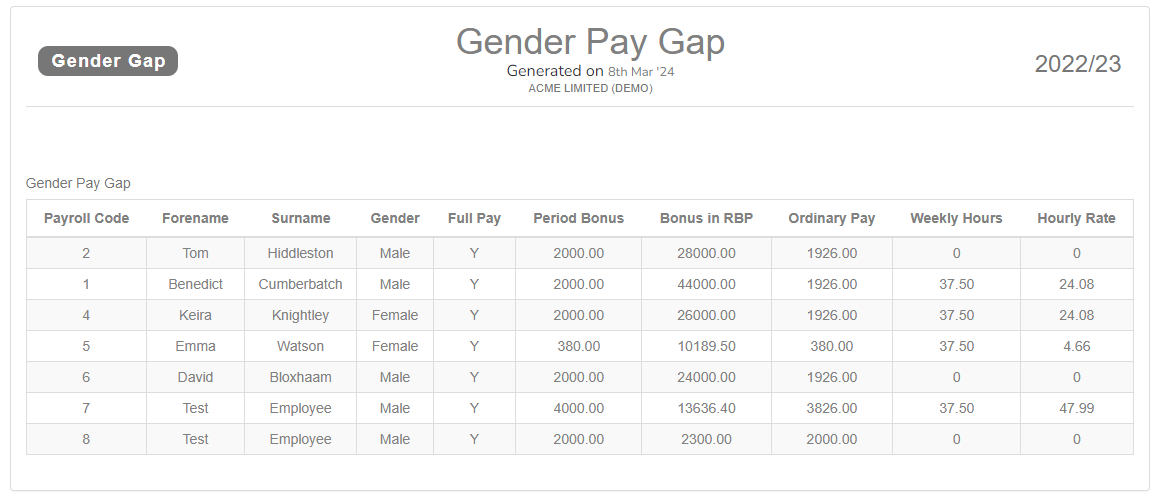

Example...

-

Gender pay gap. PDF

-

Gender pay gap. CSV

Good to know...

-

This aim is calculating out a weekly value of pay which also include the bonus period pay and ordinary pay for the period so the hourly rate can be calculated and compared.

-

You need to have a pay code set for ordinary pay and bonus pay.

-

Information on how we calculate for employees with variable hours.

-

The snapshot date changes the reference period used.

-

31st March: The last pay period that includes the pay day of 31st March.

5th April: Users the monthly pay period for April. This is usually 1st to 31st April.

-

-

If an employee has multiple roles, then both are added to together then the calculation performed.

-

GOV.UK: Gender pay gap reporting: guidance for employers. External website

-

GOV.UK: Search and compare gender pay gap data. External website