HMRC code issue

February 2025

What is the issue?

There has been an issue that may have impacted some employee records within your payroll. In certain cases, historic HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. notices were applied in error, potentially overwriting more recent notices.

How do I know If I’m one of the affected employers?

You will have been contacted by us directly. If you have not had any contact mentioning this issue, you are not impacted.

How does this affect employees?

Between 19:00 on 17/02/2025 and 17:00 on 19/02/2025, if you had an open Pay Run with automatic HMRC notices enabled, Staffology Payroll may have applied previously unapplied Tax Code and / or Student Loan A government loan that students can use to help pay for their education. notices.

Our records indicate that at least one of the Employers you process in Staffology Payroll may have been impacted. We are writing to share the list of impacted Employers and Employees with you.

If the employee left in a period finalised before 17th Feb 2025, you do not need to take any action.

What do I need to do?

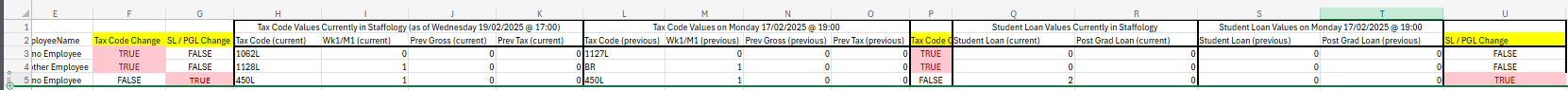

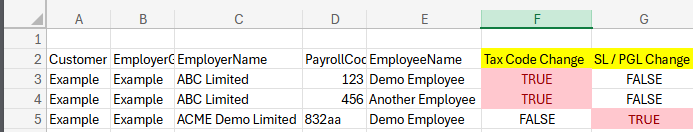

Please review the list of employees in the spreadsheet that we have securely shared.

Each of them has had a Tax Code Change and / or a Student Loan change, where the effective date of the HMRC notice was earlier than February 2025. We have deemed these changes as potentially incorrect.

Use the spreadsheet key and refer to the How do I check if the codes are correct? section to determine whether these changes were applied in error.

Column C: Employer name.

Column D: Employee / payroll code.

Column E: Employee name.

Column F: Tax Code Change - TRUE / FALSE.

Will show as TRUE if the employee was identified as having a tax code change during the impacted dates.

Column F: Student (SL) / Postgraduate Student Loan (PGL) - TRUE / FALSE

Will show as TRUE if the employee was identified as having a SL / PGL change during the impacted dates.

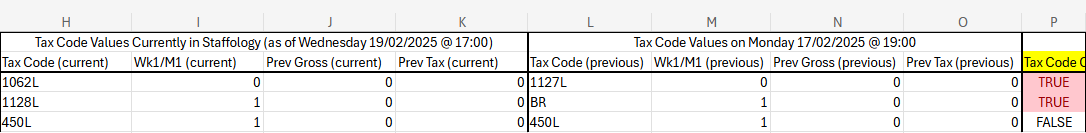

Column H - K: What are Tax Code fields currently set as in payroll (as of 17:00 on 19/02/2025).

Column L - O: What were the Tax Code fields set as before the issue (as of 19:00 on 17/02/2025).

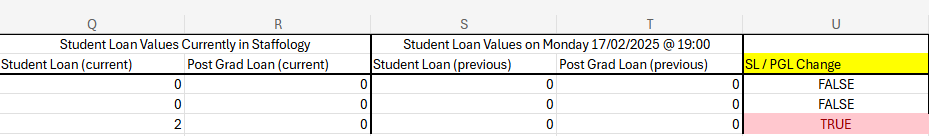

Column Q - R: What are Student Loan fields currently set as in payroll (as of 17:00 on 19/02/2025).

Column S - T: What were the Student Loan fields set as before the issue (as of 19:00 on 17/02/2025).

How do I check the codes are correct?

-

Go to the HMRC tab and review the latest notice for each employee we have identified.

or

-

Check the HMRC portal and review the latest notice for each employee we have identified.

What is the impact on the payroll?

Pay run is still open and not yet paid

-

Update the tax code / student loanA government loan that students can use to help pay for their education. settings against the permanent employee record.

-

Check this change is reflected in the open pay tun.

Impact on the employees: None

-

The net pay paid to employees will be correct.

-

The tax code and tax deducted reported and paid to HMRCHis Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. will be correct.

Pay run finalised but not yet paid

Fix 1: Recommended

-

Re-open the Payroll and update the tax code / student loanA government loan that students can use to help pay for their education. settings against the permanent employee record.

-

Ensure the change is reflected in the now open pay run.

-

Re-finalise the payroll and submit the new FPSFull Payment Submission is an RTI online submission to be sent on or before each payday. This informs HMRC about the payments and deductions for each employee. / payment file.

Impact on the employees: None

-

The net pay paid to employees will be correct.

-

The tax code and tax deducted reported and paid to HMRCHis Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. will be correct.

Fix 2:

-

Make the changes and these come into effect next pay run.

Impact on the employees: Some

-

For employees not on a week 1 tax code, this should correct itself over the remainder of the year.

-

For employees on a week 1 tax code, this won't necessarily correct itself, but HMRC would either issue a rebate, or adjust the tax code dependent on the under/overpaymentA situation in which an employee receives more money than they are entitled to, often due to an error in the payroll calculations. of tax.

Pay Run first impacted is Finalised and has had payments made to employees

Fix 1: Recommended

-

Re-open the Payroll and make the tax code changes against permanent employee records.

-

Ensure the change is reflected in the now open Pay Run.

-

Re-finalise the Payroll and submit the new FPSFull Payment Submission is an RTI online submission to be sent on or before each payday. This informs HMRC about the payments and deductions for each employee..

-

Make a net adjustment in the following ray run to correct for the net pay under/over paid to the employee.

If there is an overpaymentA situation in which an employee receives more money than they are entitled to, often due to an error in the payroll calculations./underpayment follow the procedures in the contract of employment or employee hand book.

Impact on the employees: None

-

The net pay paid to employees will be incorrect, and will need manually adjusting the following period.

-

The tax code and tax deducted for the impacted that is reported and paid to HMRCHis Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. will be correct for the impacted pay run.

Fix 2:

-

Make the changes and these come into effect next pay run.

Impact on the employees: Some

-

The net pay paid to employees will be incorrect.

-

For employees not on a week 1 tax code, this should correct itself over the remainder of the year.

-

For employees on a week 1 tax code, this won't necessarily correct itself, but HMRC would either issue a rebate, or adjust the tax code dependent on the under/overpayment of tax.

How do I update the employees?

Using the spreadsheet, listed are the companies and employees we have flagged as impacted.

-

Open the required company.

-

Go to Employees.

-

Select the required employee.

-

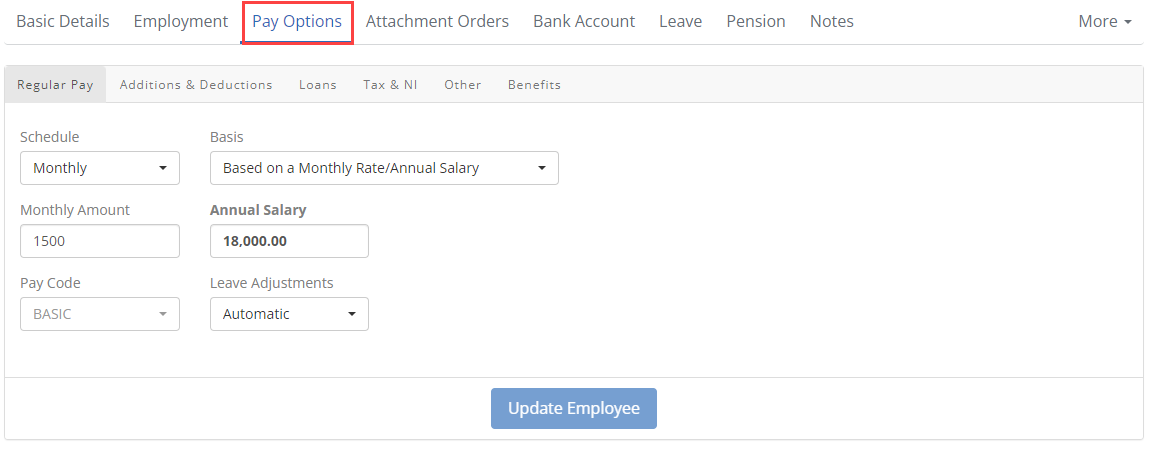

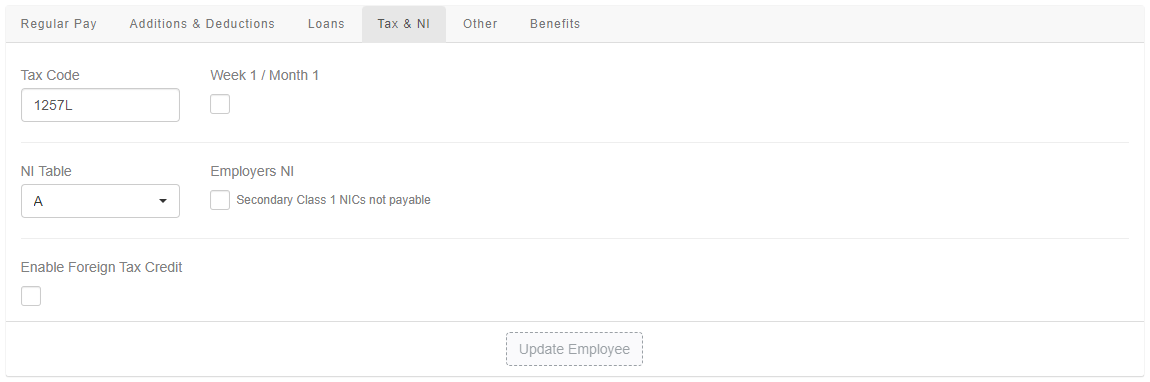

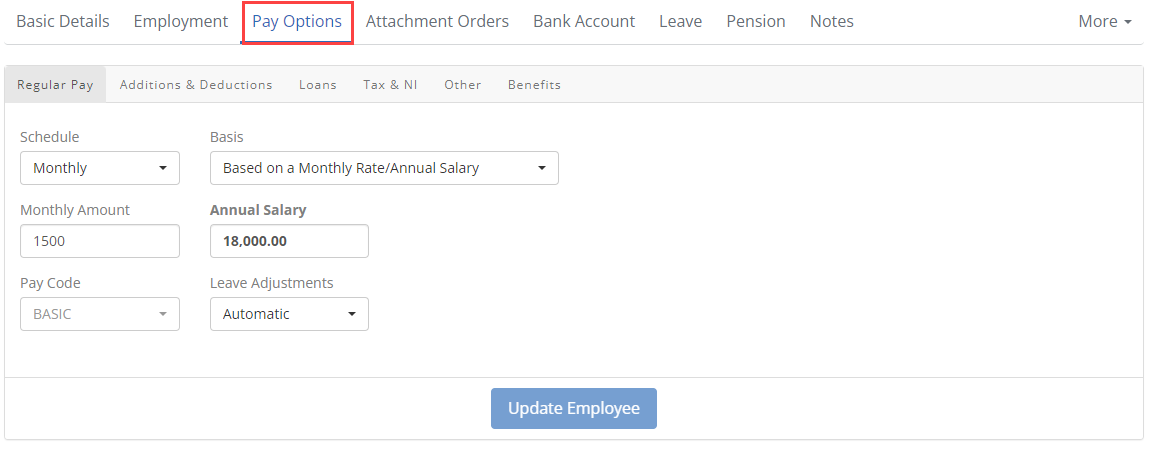

Select Pay Options.

-

Select Tax & NI.

-

Enter the Tax Code.

-

Select Week 1 / Month 1 as required.

-

Select Update Employee.

-

Open the required company.

-

Go to Employees.

-

Select the required employee.

-

Select Pay Options.

-

Go to Other.

-

Select Student LoanA government loan that students can use to help pay for their education. if required.

-

Choose the required plan.

-

-

Select PostGrad Loan if required.

-

Choose from Yes or No.

-

-

Select Update Employee.

-

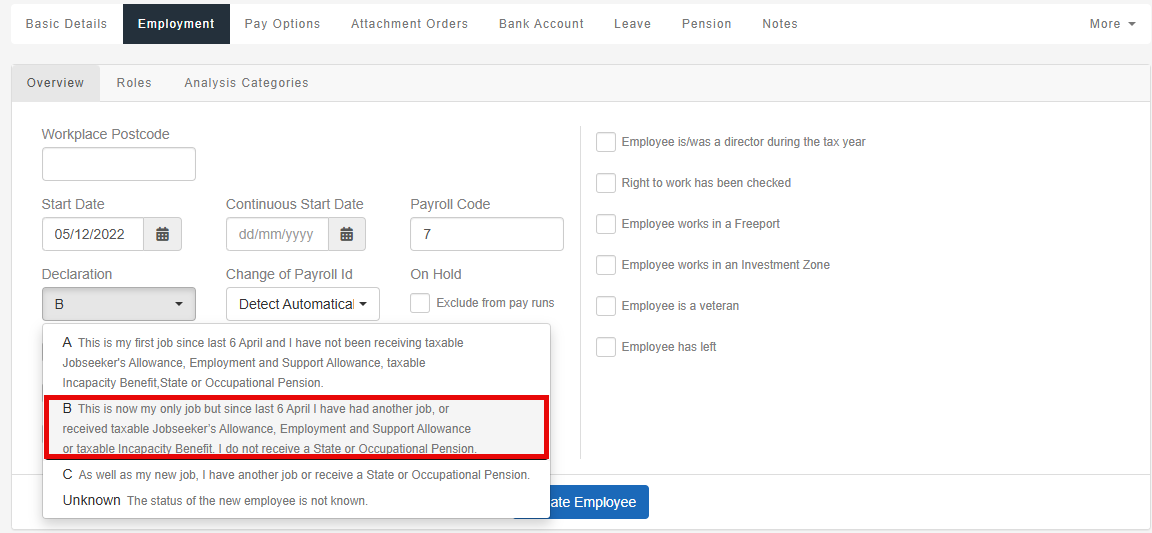

Open the required company.

-

Go to Employees.

-

Select the required employee.

-

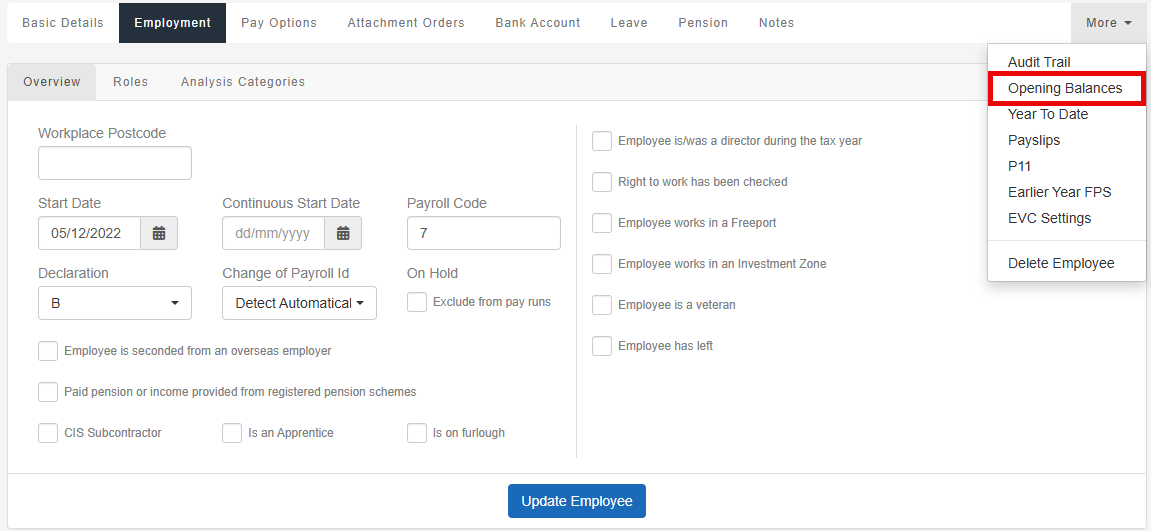

Select Employment and select Overview.

-

Go to Declaration and Choose B This is now my only job but since last 6 April I have had another job, or received taxable Jobseeker’s Allowance, Employment and Support Allowance or taxable Incapacity Benefit. I do not receive a State or Occupational Pension.

This will allow you to edit the opening balance.

-

Select Update Employee.

-

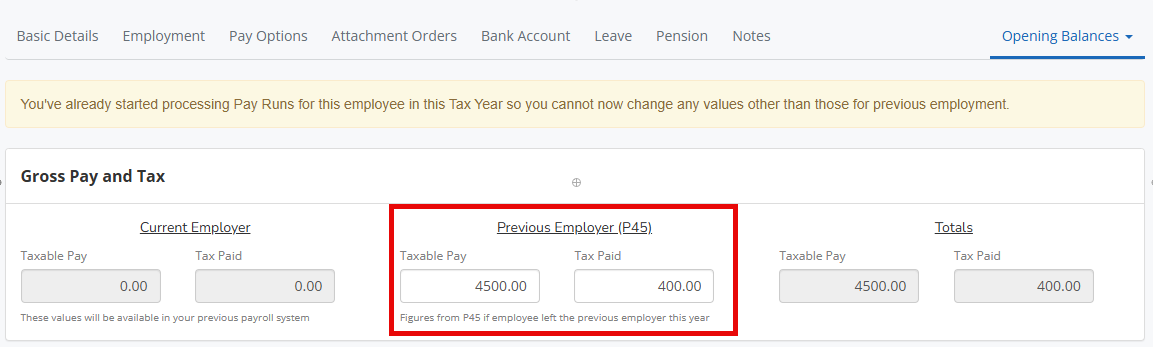

Select the employee.

-

Go to More and select Opening Balances.

-

Enter the correct figures.

-

Select Back to Employee then Update Employee.

Can you provide more detail on the issue and how you identified the employees?

The spreadsheet that we have shared is a list of all Employees that have had a change to their tax code and / or their student loan fields, and where they have had an HMRC notice that was applied between 19:00 on 17th February and 17:00 on 19th February.

The effective date of the HMRC notice that was applied was earlier than 01 February 2025.

There’s a possibility that due to the issue outlined above, the change was caused by a historic HMRC notice being applied in error.

This could mean the employee’s current Tax Code / Student Loan settings are incorrect, and could have overridden a more recent HMRC notice applied for that employee

Are all of the changes you have shared definitely incorrect?

No - we can’t be sure that all of the changes we have sent are incorrect. We are just showing you changes triggered from a tax code notice earlier than February 2025. However, there are some legitimate circumstances where this may be correct - for example a notice that came in late January after you had finalised the January Payroll.

Other known issues

Issue: Future year tax codes being applied in month 12. (N/A)

Information: Tax codes for the following tax year are being applied in month 12 when the work period falls into the new tax year despite the pay date being in the current tax year. (the employee is being paid partly in advance)

ETA*: 31st March

Severity:Low

Issue: Manually applying tax codes that are dated for tax year 25/26. (74352)

Information: Where tax codes have been downloaded for tax year 25/26 these should not be applied whilst the payroll is still in Tax Year 24/25. Doing so will result in an incorrect application of the tax code in this tax year.

ETA*: 31st March

Severity:Low