Benefits: Year end roll over

Benefits in Staffology Payroll will not carry over to the new tax year automatically.

To add benefits to the following year:

Annual Type Benefits

Typically when an annual benefit is created it will be processed in full during the tax year for which it was created.

For example a Medical benefit was created with a cost of £1200 starting from 6th April 2024

This will be processed each period at £100 per period (if monthly) assuming there were sufficient funds to allow this. Therefore at year end there will be no balance left to carry over into the new tax year. However as a user you may wish to recreate the same benefit for the new tax year.

Run the benefits export and re import:

-

Open the required company.

-

Go to Reports and select Employees.

-

Select Employee Benefits.

-

Select the current Tax Year.

-

Go to Options and select Benefits.

-

Select Download CSV.

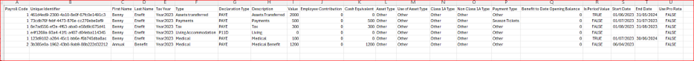

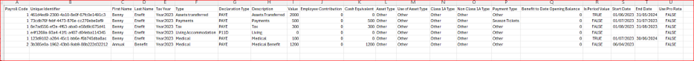

How do I identify which benefits are annual?

-

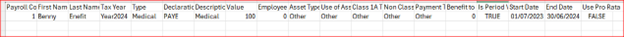

Column R states “Is Period Value”. Where this is FALSE that means the benefit is an annual type.

Remove any non annual benefits from the file (You can load a mixture of Annual and Period values if you want to).

-

Delete Column B – Unique Identifier (If this is used it will override the existing benefit).

-

Change Column E – To read the New tax year in this example Year2024.

-

Column I – Ensure the value you are using for the new year is correct.

-

Column K – Delete the cash equivalent as this will auto generate on load of the value.

-

Column S – Ensure date is in the new tax year.

If you load the benefits whilst in the old tax year you will not see them displayed until you roll into the new tax year. The recommendation is that you load when you have rolled over into the New tax Year.

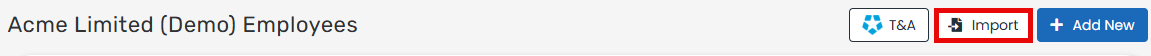

To upload the new benefits CSV:

-

Select the required comapny.

-

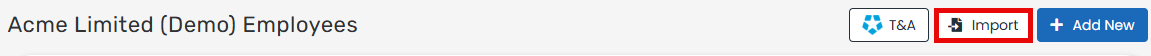

Go to Employees.

-

Select Import.

-

Select Benefits and the browse for your CSV upload file

Period Value benefits

Typically when an period Value benefit is created it will given a start and end date for which is to be processed.

In future tax years the period benefits will roll over into the new tax year if they are still considered active. However the WILL NOT do this for the 24/25 year end moving into 25/26

Therefore the benefits will need to be recreated in the new tax year to ensure that they continue to be taken.

Run the benefits export and re import:

-

Open the required company.

-

Go to Reports and select Employees.

-

Select Employee Benefits.

-

Select the current Tax Year.

-

Go to Options and select Benefits.

-

Select Download CSV.

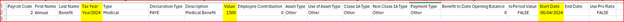

How do I identify which benefits are periodic?

-

Column R states “Is Period Value”. Where this is TRUE that means the benefit is a period type.

Remove any annual benefits from the file (You can load a mixture of Annual and Period values if you want to).

-

Delete Column B – Unique Identifier (If this is used it will override the existing benefit).

-

Change Column E – To read the New tax year in this example Year2024.

-

Column I – Ensure the period value you are using for the new year is correct.

-

Delete Column K – The cash equivalent calculates as the benefit is processed each period.

-

Column S – Start Date Can Remain as is.

-

Column T – End date can remain as is.

If you load the benefits whilst in the old tax year you will not see them displayed until you roll into the new tax year. Therefore the recommendation is that you load when you have rolled over into the New tax Year.

To upload the new benefits CSV:

-

Select the required comapny.

-

Go to Employees.

-

Select Import.

-

Select Benefits and the browse for your CSV upload file

Car Benefits

Car benefits will automatically roll into the new tax year if:

-

There is no available to date present.

-

There is and available to date entered that is in the new tax year.

They will not roll forward if

-

The benefit had an available to date that means it ended in the previous tax year.

The benefit for the new year will inherit the identical setting as for the previous year.

Loans

Beneficial Loans will not automatically roll forward.

The expectation is that these will be added manually when required as there is a need to know the closing balance (that obviously won’t be known at this point) in order to complete the calculation.