Pay codes

You can view the list of Pay Codes by selecting an employer name in the main menu and going to Settings > Pay Codes.

The screen divides into three tabs.

| Tab | Detail |

| Custom codes |

Area for any bespoke codes.

Typically these would be for commission, bonuses or anything you want to track separately to basic pay The standard amount paid to an employee which excludes additional payments like bonuses, overtime, and allowances..

You should not set up codes for SSP Statutory sick pay refers to the pay an employer must give you if you’re too ill to work. It’s paid to you by your employer for up to 28 weeks, based on certain eligibility criteria - the cost of SSP is no longer able to be recovered - SSP is no longer reported to HMRC on your EPS submissions or other statutory pay types, as we set them up as System Codes. |

| System Codes |

You cannot edit all of these codes. The software uses these for specific purposes, inferred from their names.

You can allow for a employer to manually enter Statutory Payments, if required. Enable from the Pay Codes screen.

|

| Control Codes |

You cannot edit these codes. They are used to work out the resulting accounting entries from a pay run. |

| Employer codes | You cannot edit these codes. Employer Codes are used when working out the resulting accounting entries from a pay run. |

Create or edit a new Pay Code

-

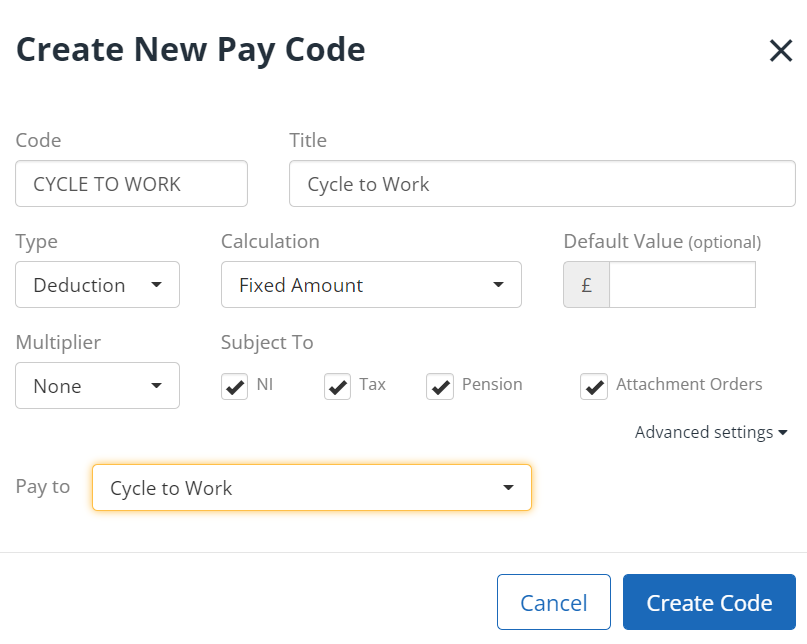

Select Add New, or, to edit an existing one, select it.

-

Update the details.

Option Details Code You can use anything you like as the code, although it must be unique.

Title The payslips will use this description, by default, for any lines using this code.

Type Select whether this code is an addition or deduction. Calculation Selecting Fixed Amount allows you to enter an exact amount to add or deduct when adding this code to a payslip A statement provided by an employer to an employee, detailing their wages, deductions, and net pay for a specific pay period.This is a legal requirement under the employment rights act and should be received on or before the pay date..

Or you can choose Multiple of Hourly Rate to set 1 code that pays 1x, 2x, etc. of the employee's base hourly rate – i.e. for overtime payments.

Alternatively, we can automatically calculate a percentage of Net or Gross pay.

Default Value (optional) You can choose to enter a default value for this code.

Then, whenever you add it as a new line to a payslip, the value will be filled automatically for you.

Multiplier With calculation specified as Fixed Amount, you can choose to set this code to be a multiple of hours or days.

If left set to None, you only enter the amount to add or deduct. Choose hours or days and provide the daily or hourly rate and the number of days or hours to pay.

With Calculation specified as Multiplier of Hourly Rate, enter the multiplier value. For example, to double the usual rate for an employee, enter ‘2’.

Subject to Select the relevant boxes to make any additions and deductions assigned to this code subject to:

-

Tax

-

NI

-

Calculations for pensionable pay

Attachment Orders This is relevant if any of your employees have Attachment Orders. Only pay that is attachable is used to calculate deductions. If in doubt, tick this box. Pay to Select who to pay the deduction to from the Pay to list.

The field is only visible if you have Payees configured (Payees can also be accessed from the Settings menu). By default, Pay To sets to None, but you can select one of your previously created Payees.

-

Advanced settings