Net to gross payments

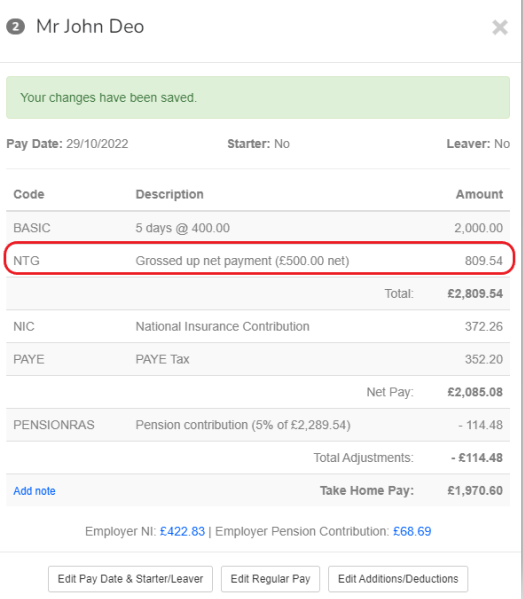

The Gross up Target Net allows you to enter a net amount you want an employee to receive. In the background, the system then calculates the grossed-up figure required for the employee to receive the net amount specified. For instance, this is particularly useful if you want to pay an individual a net bonus.

To enter a one-off net to gross payment

-

From Employers > Settings > Pay Codes, set up a Pay Code for the net to gross payment Calculates the gross amount you need to pay in order for the employee to receive a certain amount of net pay.

-

Go to Payroll and select the individual.

-

Select Edit Additions/Deductions and + New Addition/Deduction.

-

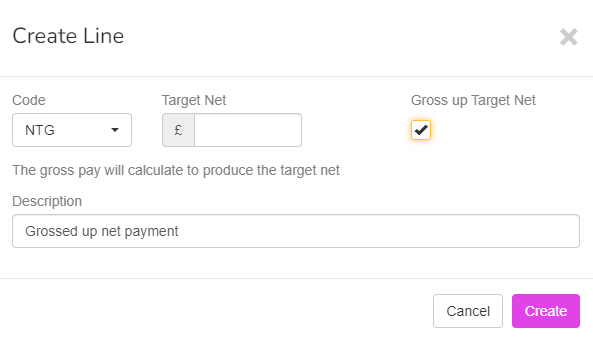

From the Code dropdown, choose the one configured for the net to gross Calculates the gross amount you need to pay in order for the employee to receive a certain amount of net pay..

-

Select Gross up Target Net.

-

In Target Net, enter the required net for the payment.

-

Select Update.

-

To produce the Target Net, the software grosses up the payment. In this example, £500 becomes £809.54.