Guide to tips, tipping and allocating tips

Employers must ensure that tips are allocated and distributed in a fair, reasonable and timely manner.

Money paid through voluntary tips and service charges must be passed on no later than the end of the following month.

Background to the Employment (Allocation of Tips) Act 2023

The Employment (Allocation of Tips) Act 2023 (Tips act) came in response to a campaign by trade unions and workers. They argued some businesses were taking a substantial portion of the tips or they were distributing them unfairly. Some staff said they were receiving none of the tips and service charges that customers paid.

100% of mandatory service charges must be passed on too under the law, but cannot be paid as tronc.

-

Businesses need to have a clear and easy-to-understand tips policy that outlines how tips are allocated and distributed. This policy must be shared with all workers, including agency workers, and should be updated regularly. Tips should be distributed fairly by the end of the calendar month following the date in which the tip has been taken.

-

The Tips Act provides specific guidelines for agency workers, but consultation with workers about the policy is not legally required. Cash tips paid directly to workers or through digital platforms without employer interference are not covered by the Tips Act.

Government code of practice

-

The Department for Business & Trade have published a Code of Practice on Fair and Transparent Distribution of Tips PDF External website

-

The Code does not clarify what is defined as fair allocation or distribution of tips, leaving it open to interpretation.

-

The Code outlines that employers must distribute tips fairly between all workers using clear and reasonable factors, such as performance, seniority, and the length of service. Employers must also avoid discrimination and inform all about their entitlements and the policy in plain language.

Some considerations

-

Multi-site pooling: The legislation does not allow tips to be pooled across multiple sites. This could drastically change your operation of the scheme, particularly for businesses with several venues. Shared areas i.e. centralised booking or a pre processing kitchen employee may receive a proportion of the tips from any other site.

-

Inclusion of agency workers: You have to include agency workers in the distribution of tips. If your business relies on agency staff, you may need to revise your scheme to accommodate this. This will also impact the amount of the tips pool your contracted staff receive!

-

No tips reserve: You can't keep a portion of tips to go into a “rainy day” jar to be distributed during times when there’s a custom shortfall. The law says that money paid through voluntary tips and service charges must be passed on no later than the end of the following month.

-

Fees can't be deducted: You can't deduct credit card fees or the cost of a 3rd party tronc scheme from the tips.

-

Pay negotiations: Any negotiations - whether with prospective workers or those seeking a raise - cannot put an increased share of tips on the table if it’s to top up a salary. Employers will have to clearly state the proper basic pay The standard amount paid to an employee which excludes additional payments like bonuses, overtime, and allowances. amount excluding tips on an employee’s contract, or they will become liable to pay the full wage stated.

An employer may share their written tipping policy with customers or display it publicly if they wish, but this is not a requirement of the Tip act.

Troncmaster

A troncmaster is the person or group who decide on the allocation of tips within the business. This should not be anyone who has control of the business. This includes the owner, senior leaders / directors and any managers / team leaders who have a say over the employee. (for example hiring and firing).

The troncmaster helps decide on how tips are allocated within the organisation. This is then formalised within the tip policy. They are the ones to regularly review the process. This guide must be given to employees.

This is to ensure fairness and is used by the person calculating the distribution of tips along with records.

The troncmaster may work within the business or outsourced to a specialised company to manage it for you.

If the employer or other person with influence in the business decides on the distribution themselves then tips are subject to tax and national insurance A system of contributions paid by workers and employers in the UK, which funds various state benefits, such as the State Pension and Jobseeker's Allowance. when paid through paye PAYE or Pay as you earn is an HM Revenue and Customs’ (HMRC) system to collect Income Tax and National Insurance from employment..

Would you like peace of mind that your tipping practices comply with the Allocation of Tips Legislation? Contact us for a free, no-obligation call with one of our experts who can help you to determine any next steps your organisation needs to take. Contact Tronc Services External website

Paying tips

Lets talk VAT

Tips are outside the scope of VAT when genuinely freely given. This is regardless of whether the customer requires the amount to be included on the bill, payment is made by cheque or credit or debit card or the amount is passed to employees.

Full details are on the GOV.UK website. Guidance on tips, gratuities, service charges and troncs - Section 4. VAT. External website

Are tips subject to tax and NI?

Customers give tips directly to employees, leave them for the employee without the employer involvement

PAYE does not apply. Tax will be due on these amounts, employees should be made aware they should complete a self assessment and this will be paid direct y or more likely through a change of tax code. No national insurance is due.

If your employee does not fill out a tax return then they must report the amount of tips they have received. They can do this either online using the personal tax account External website or by calling HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers.’s Income Tax enquiries helpline. External website

Tips paid by the employer to the employee.

PAYE does apply, The employer will calculate the tips based on the policy guide (or this can be outsourced to a specialist) and is processed through the payroll. Tax is deducted from the payment during the payroll run. National Insurance is not paid on tips if they are allocated or paid by a troncmaster by a legitimately agreed tronc scheme allocation method. If an employer allocates the funds, National Insurance is due as normal. If the business or troncmaster allocates funds in a manner against the law, the employee(s) may take an employer to a tribunal.

-

Open the required company.

-

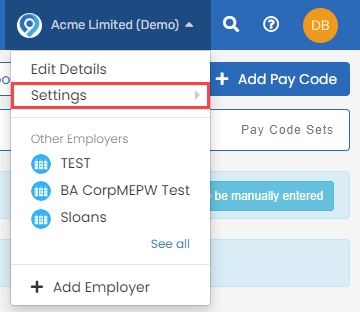

Select the company name and select Settings.

-

Go to Pay Codes.

-

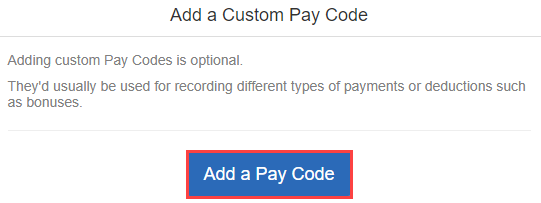

Select Custom Codes.

-

Select a pay code to edit an existing code or Add a Pay Code.

-

Go to Code and enter a unique short name.

-

Enter the Title. This is the description shown on the employees payslip A statement provided by an employer to an employee, detailing their wages, deductions, and net pay for a specific pay period.This is a legal requirement under the employment rights act and should be received on or before the pay date..

-

Go to Type and select Addition.

-

Tronc scheme:

Go to Subject To and remove the selection from NI, Pension and Attachment Orders. (unless your scheme runs differently).

Employer allocating the funds:

Go to Subject To and select NI, Pension and Attachment Orders.Ensure you have the correct Tax, NI, Pension and Attachment order selected.

-

Tronc scheme:

Remove the selection from Is Qualifying Earnings To assess the employee we use the Earnings Trigger for automatic enrolment – This is based on the qualifying earnings elements. This is made up of pay elements like Salary, Hourly Pay, Overtime, Commission, Bonus, Statutory Payments etc. Once the employee has been assessed then that trigger is no longer used. for AE if tips are to be excluded from the automatic enrolment pension abasement.

Employer allocating the funds:

Tips are subject to qualifying earnings and pension is deducted if using a qualifying earnings based scheme (such as NEST).Please contact your pension provider if in doubt. Getting this setting wrong may result in a fine from The Pensions Regulator.

-

Select Create Code.

-

This payline is used to pay the distributed tips and it will be included as part of the regular payrun.

Record keeping

-

A tipping record must include detail of all qualifying tips received by the employer at the place of business, and the amount allocated to each worker. This record must kept for three years beginning from the date the tip was paid.

-

A worker has the right to make a written request – one request per worker in a three month period – to view the tipping record of their employer. This has to include information for that employee, you should not include amounts for anyone else as this would be against GDPR The General Data Protection Regulation (GDPR) is a data protection law which focuses on personal data. compliance.

Would you like peace of mind that your tipping practices comply with the Allocation of Tips Legislation? Contact us for a free, no-obligation call with one of our experts who can help you to determine any next steps your organisation needs to take. Contact Tronc Services External website

Tips and average holiday pay

-

Please check if tips are included in the calculation for average holiday pay If an Employee's work has no fixed or regular hours, their holiday pay will be based on the average pay they received over the previous 52 weeks (or a average based on the available number of weeks if less than the full 52..

It is illegal for tips to be used to count towards minimum wage.

Tronc Troubleshooter guide PDF from Troncmasters. External website

Good to know...

-

Non-monetary tips can also be qualifying tips if they are received or controlled or significantly influenced by the employer.

-

Not all tips are under the scope of the Tip Act.

-

In the case of agency workers, any references to “employer” refer to the hirer for this engagement i.e. the place of business where they are working, even where their contract of employment is with an employment agency.

-

Allocating and distributing tips fairly does not necessarily require employers to allocate the same proportion of tips to all workers. There must be clear, fair and objective factors as to why there are differences.

-

Employers must avoid any form of unlawful discrimination when selecting and applying the factors for allocating and distributing tips.

-

Tips reserves are not to be used.

-

An employer should ensure they have fair processes in place for resolving issues and responding to queries from workers who have not received the share of tips they expected to.

-

Department for Business & Trade: Code of Practice on Fair and Transparent Distribution of Tips. PDF External website

-

GOV.UK Guide: Guidance on tips, gratuities, service charges and troncs. External website

-

GOV.UK Guide: When National Insurance and PAYE is due on tips, gratuities and service charges (E24). External website

-

GOV.UK Guide: Tips at work. (aimed at employees) External website

-

Troncmasters: https://www.troncmasters.co.uk/ External website