Guide to net to gross payments

There are instances where you want to ensure an employee receives a specific amount in their bank account. Generally earnings are paid gross, with tax, ni, pension and other items deducted. The remaining amount is the net, the amount paid to the employee.

Sometimes, you want an employee to get a set amount, this could be for the whole pay or for a single pay line. Bonuses are a common use for net to gross Calculates the gross amount you need to pay in order for the employee to receive a certain amount of net pay..

Net to gross will take the amount you enter and add on the amount needed so when its paid and the deductions are made they get the amount.

A net to gross payment Calculates the gross amount you need to pay in order for the employee to receive a certain amount of net pay. is processed at payroll run time.

-

Open the required company.

-

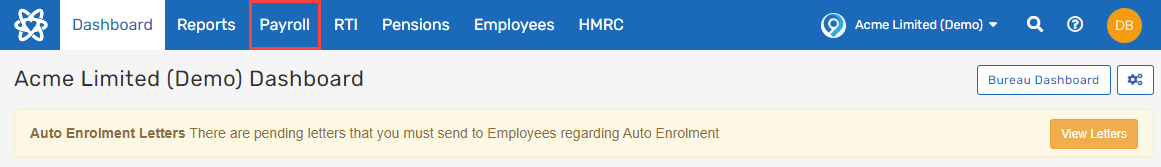

Select Payroll.

-

If you pay multiple pay frequencies, choose the frequency you are running payroll.

-

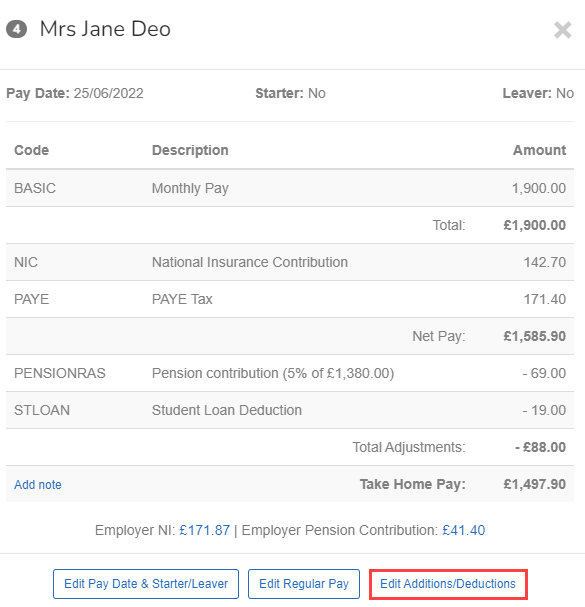

Select the required employee from the list.

You can add a note, select Add note.

-

Select Edit Additions/Deductions.

-

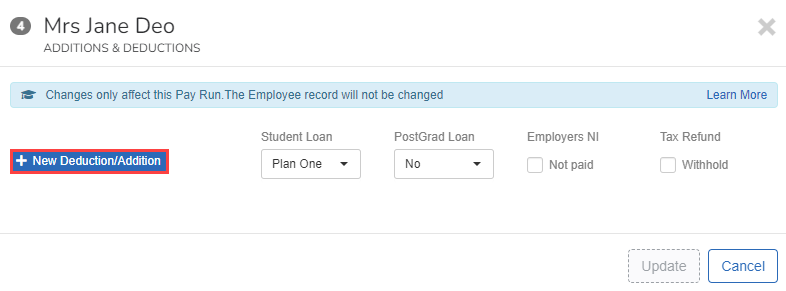

Select New Deduction/Addition.

-

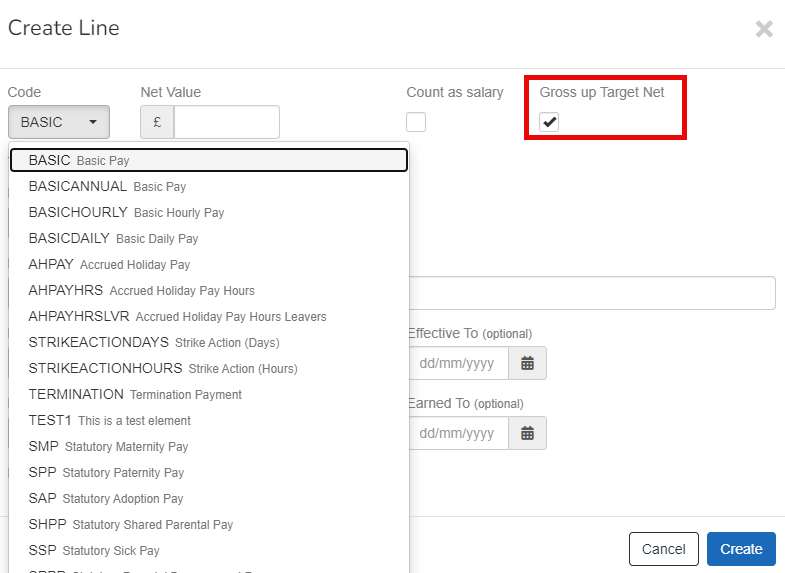

Select the required Code.

-

Enter the amount.

-

Select Gross up Target Net.

-

Select Create.

-

Select Create.

-