Statutory neonatal care pay (SNCP) and leave

Following the introduction of the Neonatal Care (Leave and Pay) Act 2023, employees with a parental or other personal relationship with a baby who is receiving neonatal care can take up to 12 weeks of paid leave which, subject to meeting the relevant criteria, will be paid at the statutory rate.

What Staffology Payroll will do:

-

Allow entry of SNCP information.

-

Allow User to process multiples of Tier 1 payments in blocks of multiples of 7 days.

-

Allow the User to Process a single block of Tier 2 in a multiple of 7 days.

-

Check to see if a user has a corresponding SXP payment that links with the SNCP (it will reference this for the average pay).

-

If there is not a corresponding SXP payment, calculate the Average pay based on the Relevant date.

-

Ensure that no more than 12 weeks are processed for a single instance of SNCP (validated against Birth Date).

What Staffology Payroll will not do

-

Staffology Payroll will not monitor the employee’s accrued entitlement to SNCP. This will need to be checked by the user prior to processing.

-

Record the Date Discharged.

To configure Statutory neonatal care pay (SNCP):

-

Open the required company.

-

Go to Employees.

-

Select the required employee.

-

Select Leave.

-

Select Add Leave.

-

Go to Payment and select:

-

Don't Pay: Don't pay the employee anything.

It is a legal requirement to pay an employee SNCP if they are entitled.

-

Pay as usual: Don't pay SNCP, just pay the employees usual pay.

An employee must still be paid at least the SNCP amount. You will not be entitled to SNCP recovery when Pay as usual is chosen.

-

Statutory Pay: Pay Neonatal Care Pay if the employee is entitled.

-

Custom Payment: Set a custom payment.

-

-

Go to Type and select Neonatal Care Leave.

Pay frequency will always be weeks in period.

-

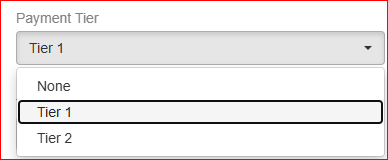

Go to Payment Tier and choose Tier 1 or Tier 2.

Good to know...

-

Multiple payments of Tier 1 are allowed but must always be multiples of 7 days (Part week payments are not allowed for SNCP).

-

Only one Tier 2 payment will be allowed for an instance of SNCP as this is the final payment to be paid after the child has been Discharged from Neonatal care and must be paid in a single block in a multiple of 7 days.

-

Enter the From and To dates.

Good to know...

-

Based on the date the Baby entered Neonatal Care, Staffology Payroll will validate the Leave start date (Will not be allowed until day 8 as the employee will have to accrue a week’s entitlement before taking the SNCP leave).

-

Staffology Payroll will validate that the leave does not exceed the 68 weeks from Baby Birth Date in which it must be completed.

-

Staffology Payroll will check that the employee is not exceeding the maximum 12 weeks entitlement.

-

Staffology Payroll uses the Date of birth to facilitate this check.

-

Select Add existing payments made if required.

-

Enter the Baby Due / Matching / Placement Date. This will calculate the average weekly earnings.

Good to know...

-

If there is a corresponding entry for this date against another SXP payment such as (SMP Statutory Maternity Pay is the pay an employer must give to female employees on maternity leave, for up to 39 weeks.,SPP Statutory Parental Pay refers to the pay an employer must give to an employee who takes time off to care for their child, or surrogate's child, for up to 2 weeks.,SAP SAP or Statutory Adoption Pay. If an employee is adopting a child with a partner, one of them may be entitled to SAP and the other may be entitled to Ordinary Statutory Paternity Pay (OSPP). SAP usually follows the same basis as SMP in terms of amounts of length of time.) it will inherit the average earnings from this.

-

If there is not a corresponding entry it will calculate an average from the relevant week.

What is the Relevant Week: Relevant week will start on a Sunday 7 to 13 days before Date of Childs Neonatal Care e.g. if Date of Childs Neonatal Care is a Sunday, the Relevant Week will be 7 days before. If Date of Childs Neonatal Care is a Saturday, the relevant week will start 13 days before.

Relevant Week example: Child goes into neonatal care on Saturday 12th April 2025. Relevant week is Sunday 30th March 2025 to Saturday 5th April 2025.

-

Enter Baby Due / Matching / Placement Date.

Good to know...

-

If there is a corresponding entry for this date against another SXP payment such as (SMP,SPP,SAP) it will inherit the average earnings from this.

-

If there is not a corresponding entry it will calculate an average from the relevant week.

-

Enter the Baby Birth Date. The date must be on or later than 06/04/2025.

-

Enter the Date Baby Entered Neonatal Care. Staffology Payroll will ensure that the baby entered Neonatal care within 28 days of birth.

-

Select the Pro Rata Rule for Absence:

-

Use Working Pattern Rule.

-

260 Rule - Deduct for days not worked.

-

260 Rule - Pay for days worked.

-

365 Rule - Deduct for days not worked.

-

365 Rule - Pay for days worked.

-

Calendar Days in Period.

-

Working Days in Period.

-

-

Select Top-up pay to usual amount (offsetting) and Use Assumed Pensionable Pay Assumed Pensionable Pay is a notional pensionable pay figure that is used to ensure that your pension is not affected if your pensionable pay reduces when you are away from work. It protects you if you are absent because of sickness, injury, or relevant child-related leave etc. Use of assumed pensionable pay would need to be indicated by the relevant pension provider, as it is not always used. if required.

-

Describe automatically will choose the text on the employees payslip A statement provided by an employer to an employee, detailing their wages, deductions, and net pay for a specific pay period.This is a legal requirement under the employment rights act and should be received on or before the pay date.. To enter your own description select Manual description.

-

Select Create.

Good to know...

-

You can add a note when adding any statutory payment to an employee record.

-

You can upload any supporting documents when creating the statutory payment.