Guide to salary sacrifice pension schemes for employees receiving SMP

If an employee is on a salary sacrifice Employee gets Tax & NI relief Employer gets Ers NI relief The deduction is made before tax and NI. There are a number of special rules with this type of deduction. scheme and receives SMP Statutory Maternity Pay is the pay an employer must give to female employees on maternity leave, for up to 39 weeks., they do not have any pension deducted.

The employer’s deduction covers the amount you usually take from the employee.

So before SMP started, the employee’s pension deduction was 5%, with an employer’s deduction of 3%. Therefore, whilst on SMP, the whole 8% would be the employer’s pension amount.

Pensionable earnings are the usual earnings before SMP.

-

Go to Employees, select the individual and then the Leave tab.

-

Select + Add Leave.

-

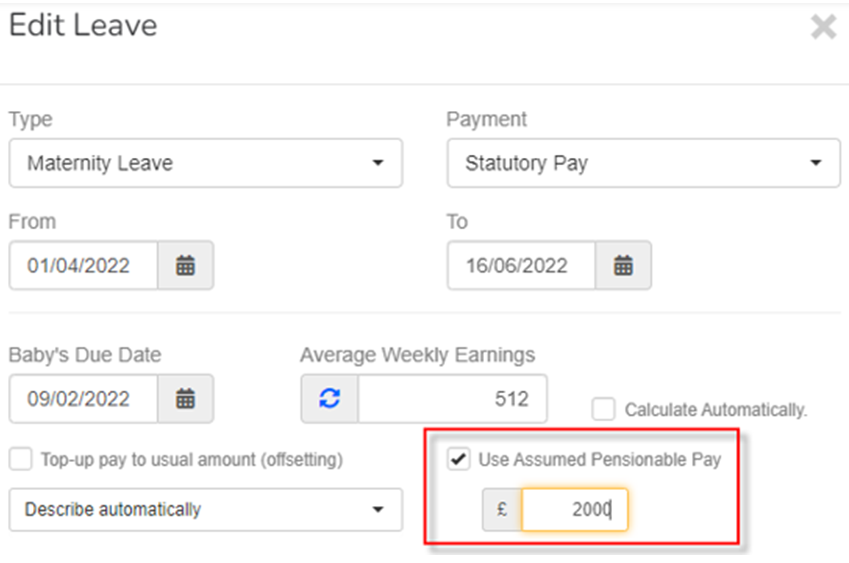

From the Type list, select Maternity Leave and set Payment to Statutory Pay.

-

Enter the Leave From and To dates, then Baby’s Due Date.

-

Select Use Assumed Pensionable Pay Assumed Pensionable Pay is a notional pensionable pay figure that is used to ensure that your pension is not affected if your pensionable pay reduces when you are away from work. It protects you if you are absent because of sickness, injury, or relevant child-related leave etc. Use of assumed pensionable pay would need to be indicated by the relevant pension provider, as it is not always used. and enter the required value – the amount pension is deducted from before SMP begins.

-

Select Update.

-

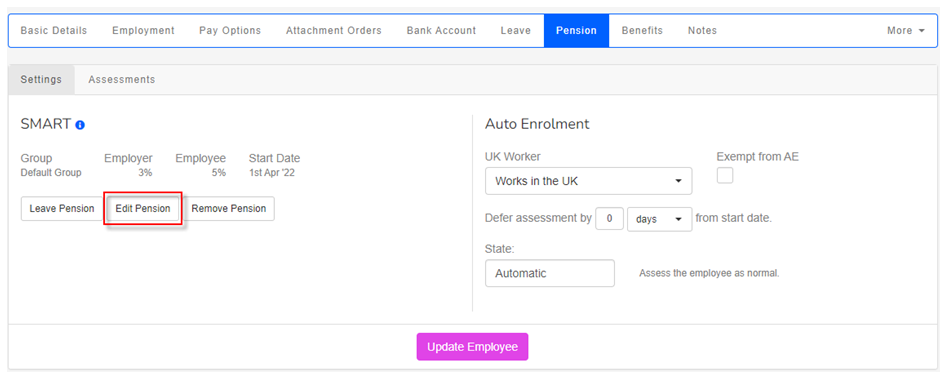

Select the Pension sub-menu, then Edit Pension.

-

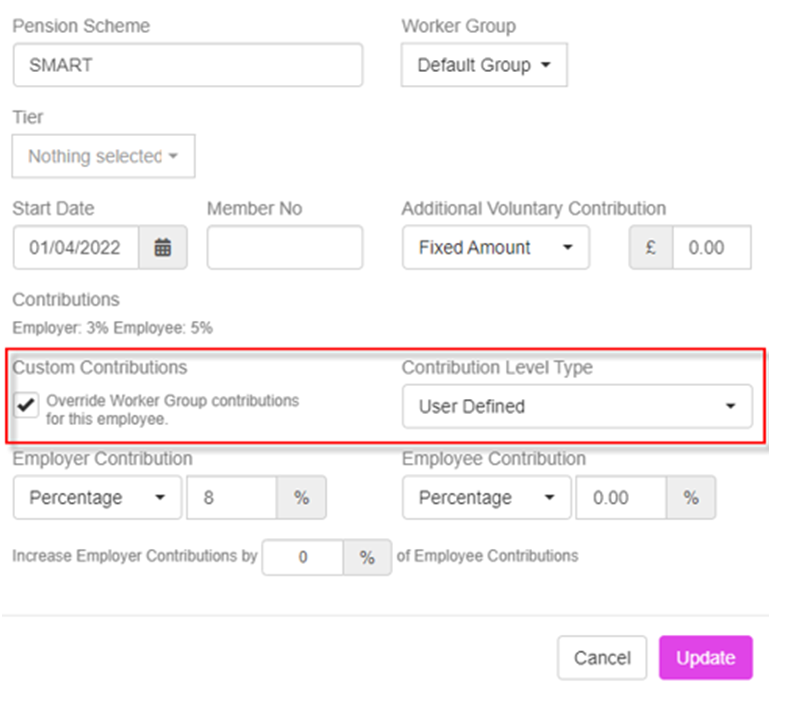

Select Custom Contributions, then set the Contribution Level Type to User Defined.

-

Change the Employer Contribution, setting the total to the usual employee and employer combined contributions. For instance, if these are usually 5% employee and 3% employer, enter 8% in Employer Contribution.

-

Set Employee Contribution to 0.00% and select Update.

-

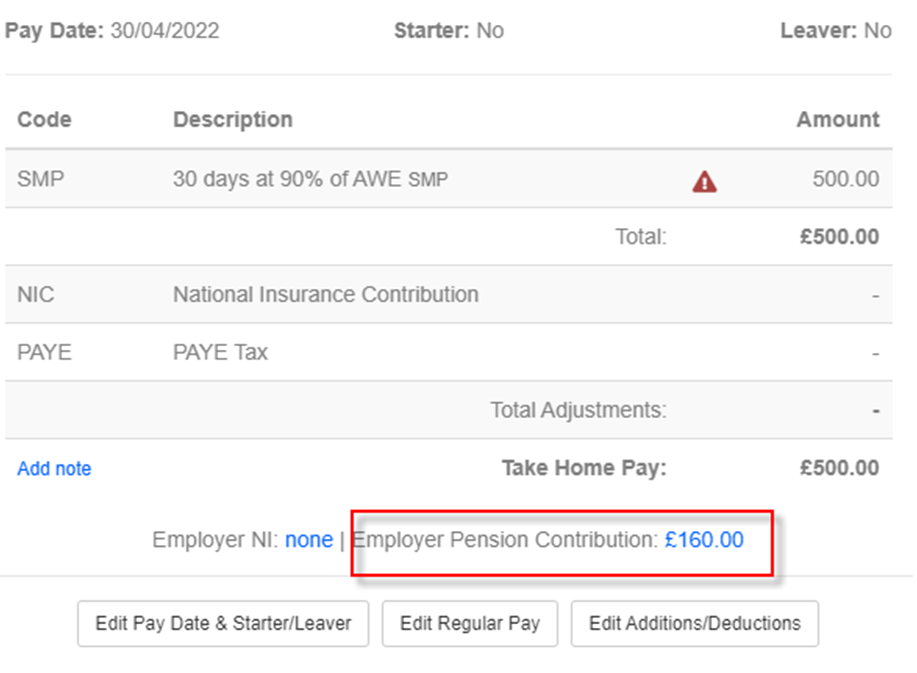

From Payroll, process your pay run.

-

In this example, the Employer’s Pension Contribution is £160.00 (2000 * 8 %). We set the Assumed Pensionable Pay to £2,000.