Foreign tax credit payments

Additional Information

HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers.: Tax on foreign income.

Find out more External Link

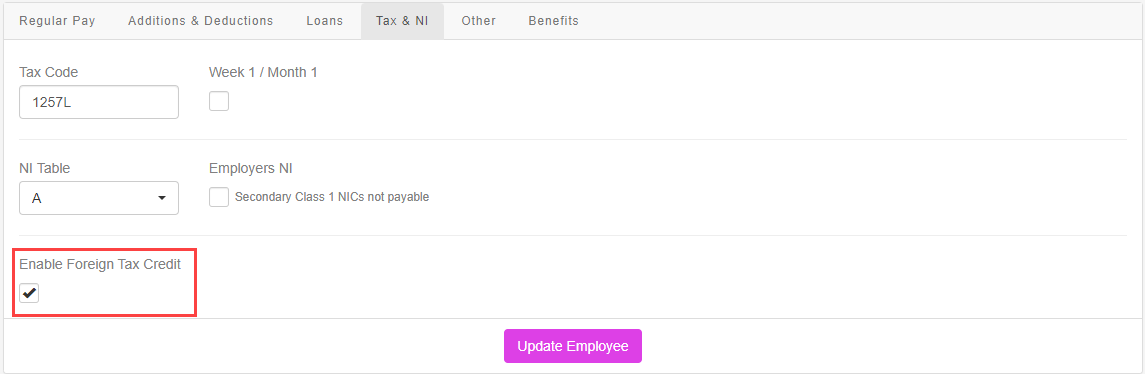

Foreign tax credit payments must be set in the employee record.

To enable foreign tax credit payments:

-

Open the required company.

-

Go to Employees.

-

Select the required employee.

-

Go to Pay Options > Tax & NI.

-

-

Select Update Employee.

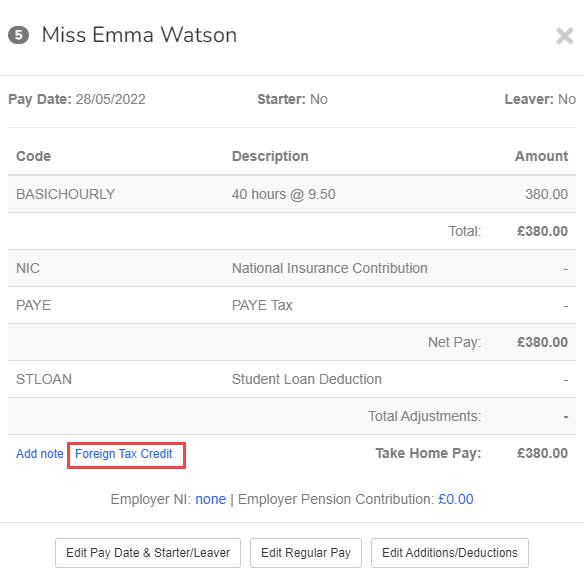

Foreign Tax Credit is available during the payroll run process.

-

During the payroll run, select the required employee.

-

Select Foreign Tax Credit.

-

Enter the amount and select Update.

Good to know...

-

This payment will be included on the full payment submission (FPS Full Payment Submission is an RTI online submission to be sent on or before each payday. This informs HMRC about the payments and deductions for each employee.) and on the Year To Date report.

-

Foreign tax credit payments must be set in the employee record.