Other

-

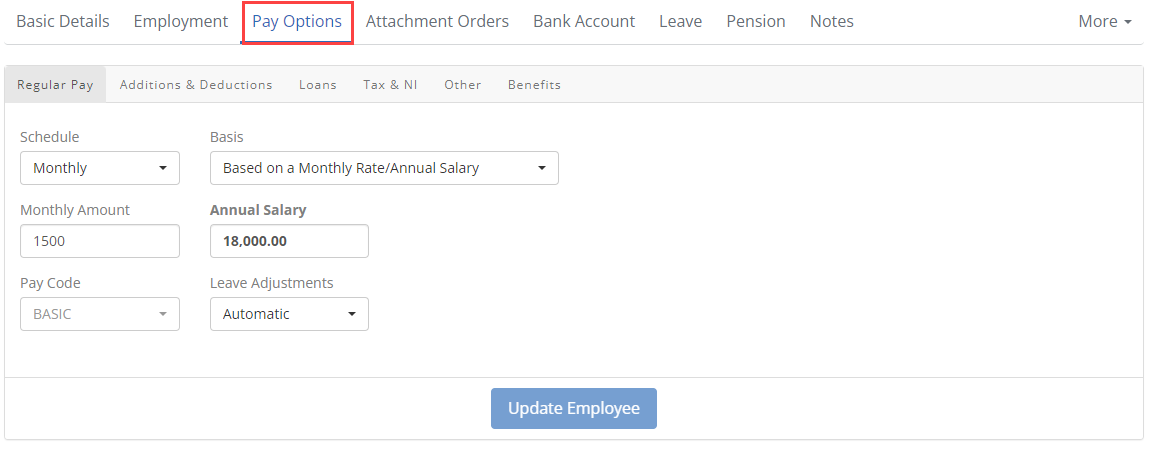

Open the required company.

-

Go to Employees.

-

Select the required employee.

-

Select Pay Options.

-

Go to Other.

-

Select Student Loan A government loan that students can use to help pay for their education. if required.

-

Select PostGrad Loan if required.

-

Select the Hrs Normally Worked / Wk.

There’s no limit to how many hours you can work. Your Universal Credit does not stop if you work more than 16 hours a week. Find out more. External website

-

Choose the Payment Method.

-

Cash: Employee receives a cash payment.

-

Cheque: Employee paid by cheque.

-

Credit: Employee is paid by bank credit / BACS Stands for Bankers' Automated Clearing Services. It's an electronic system for transferring money directly between bank accounts in the UK, often used for payroll..

-

Direct Debit:

-

-

-

Off-Payroll Worker: Employee is an off-payroll worker subject to 2020 rules. Also known as IR35 Off payroll working rules apply if the worker who provides services to a client through their own intermediary would have been an employee if they were providing their services directly to that client. The rules are sometimes known as ‘IR35’..

-

Irregular Payment Pattern An RTI employer can set the Irregular payment pattern indicator on an employee’s FPS to indicate that payments will be made to the individual on an ‘irregular’ or infrequent basis. The setting of this indicator will stop the automatic cessation of the individual’s employment record should the employer stop sending FPS for a period of time.: Employee is currently on an irregular payment pattern.

-

Non-Individual: Employee's payments are being made to a body (eg, trustee, corporate organisation or personal representative).

-

Exclude from RTI Real Time Information is the current method for reporting PAYE to HMRC, comprising FPS and EPS submissions. Submissions: Employee will not be included on any submissions to HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers..

-

-

Select Withhold Tax Refund if required.

Employees on a cumulative tax code The normal tax basis, a cumulative code works out the tax due on the total taxable pay in the current tax year every time an employee gets paid. are usually entitled to tax refunds if the payroll calculates it. Think carefully and seek advice before withholding tax refunds.

-

Choose the Vehicle Type if required.

Used if you reimburse this employee for mileage in their own vehicle. Will use the correct rate.

-

Select Update Employee.

Good to know...

-

GOV.UK Guide: Student loan and postgraduate loan repayment guidance for employers. External website

-

GOV.UK Guide: Universal Credit: How your earnings affect your payments. External website

-

GOV.UK Guide: Maximum weekly working hours. External website

-

GOV.UK Guide: Understanding off-payroll working (IR35). External website

-

GOV.UK Guide: Travel — mileage and fuel rates and allowances. External website