Recording a benefit for an employee

-

Select the required employer.

-

Go to Employees, then select the required employee.

-

The Benefits tab lists any previously recorded benefits, separated by tax years. Choose the tax year from the list.

-

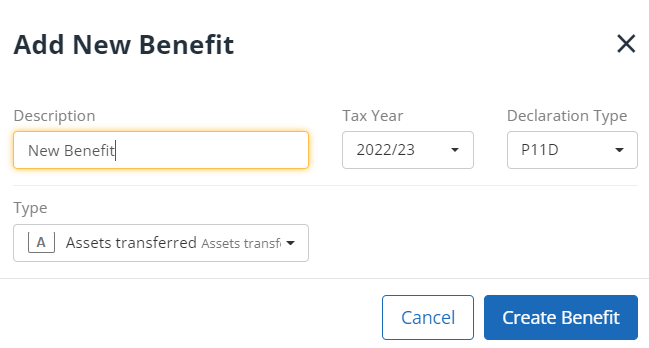

Select + Add benefit.

-

Enter the Description for the benefit, then choose the Type from the list.

-

From Declaration Type, choose whether you intend to report the benefit by either P11D or PAYE.

-

Select Create Benefit.

-

You can now add further details. The fields shown will depend on the benefit type selected.

Once you’ve created a benefit, you can’t change the type.

Payrolling of Benefits (PBiK) is an alternative to reporting benefits on a P11D P11D is used by employers to report end-of-year expenses and benefits for employees who earned more than £8,500. Employees who receive Benefits in Kind (BiK) are entitled to an end of year report that outlines their benefits and expenses in the tax year..