Pay run warnings

It's recommended you keep the settings as it will catch mistakes.

-

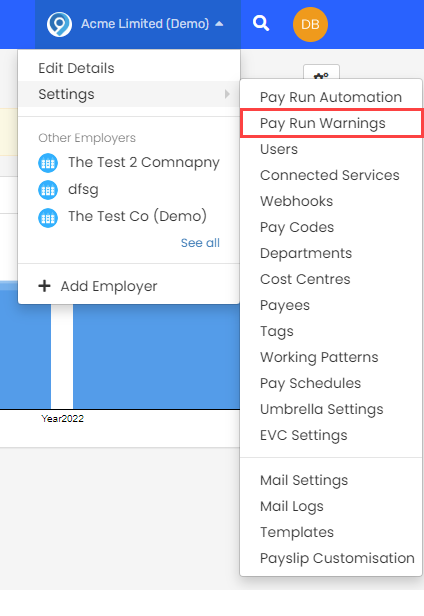

Open the required company.

-

Go to your company name > Settings.

-

Select Pay Run Warnings.

-

Items selected will be validated and display a warning if required.

-

To change, toggle the option.

-

Select Save Changes.

Warnings

-

The employee is set to be paid by 'Credit' but no bank account details have been provided.

-

The employee requires at least two address lines for the FPS Full Payment Submission is an RTI online submission to be sent on or before each payday. This informs HMRC about the payments and deductions for each employee. submission to HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers.

-

An address line contains invalid characters. Allowable characters are any of A-Z, a-z, 0-9, space or ,-()/=!"%&*;<>'+:?.

-

The employee is on an invalid NI table letter.

-

The employee is earning below the National Minimum Wage.

-

The employee's gross pay is above the threshold set for this pay schedule.

-

The employee's net pay is above the threshold set for this pay schedule.

-

The employee is in receipt of a tax refund.

-

The target net amount could not be reached. The closest available value has been used.

-

This employee has reached her full 39 weeks within this pay period.