Import pay run overrides

You can import specific overrides directly into an open pay run so you can update values for multiple employees at once — saving time and reducing manual entry.

Applies to an open pay run only.

You can not import an override for employees with multiple pension schemes of the same type.

How it works

-

Payroll Code will be used as the employee identifier during the import.

You can override the following calculated fields within the open pay run:

-

Employee NI

-

Employer NI

-

Student Loan A government loan that students can use to help pay for their education.

-

Postgraduate Loan

Imported overrides will replace the calculated values in the pay run.

Any overridden amount will update the employee’s year-to-date values — the same as if you manually edited a payline.

A ‘blank’ space on the import file will be ignored.

-

Open the required company.

-

Go to Employees.

-

Select Import.

-

Select Payments.

-

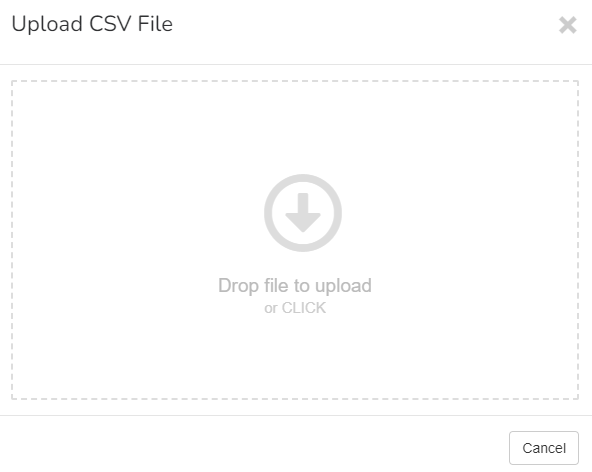

Select CSV File for <PERIOD> Pay Run Overrides.

-

Drag the file from your device or click to browse.

Example...

| PayrollCode | PAYE | Employee NI | Employer NI | Student Loan | Post Grad Loan |

| E001 | 120.50 | 85.00 | 95.00 | ||

| E002 | 110.00 | 25.00 | |||

| E003 | 100.00 | 12.50 |

Good to know...

-

A ‘blank’ space on the import file will be ignored.

-

You can only import to a open pay run.

-

The override figures will make changes to the employees year to date figures.

-

Any overridden amount will update the employee’s year-to-date values — the same as if you manually edited a payline.

-

Imported overrides will replace the calculated values in the pay run.

-

You can not import an override for employees with multiple pension schemes of the same type.

-

You can't preform an override when running supplementary pay runs or when a roll back is in progress.