View or update your payroll information

-

Sign in to Staffology HR.

-

Go to My Details in the navigation menu.

-

Select Payroll.

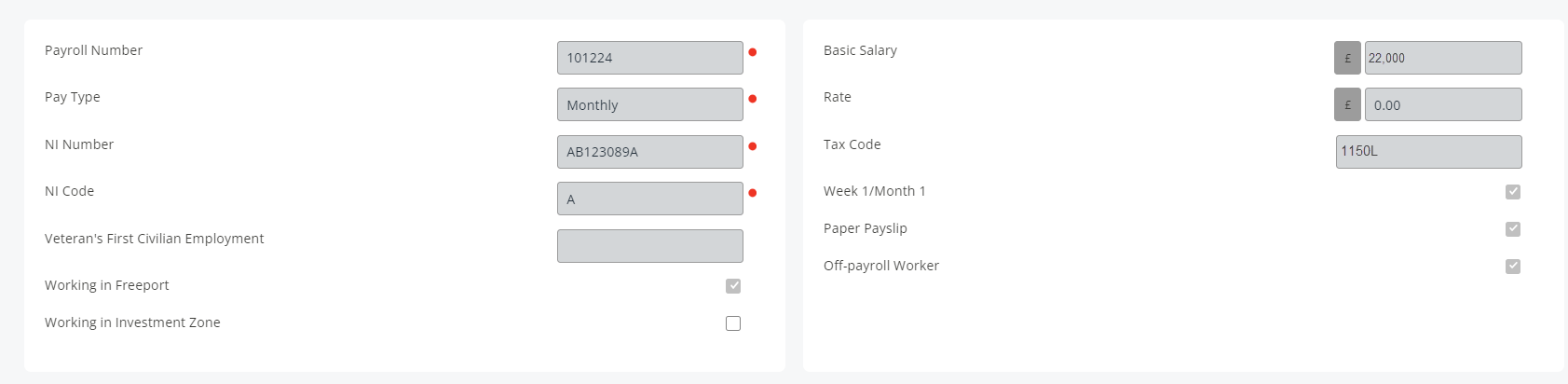

Your payroll information such as your Payroll Number, Basic Salary, Tax Code, and more is displayed.

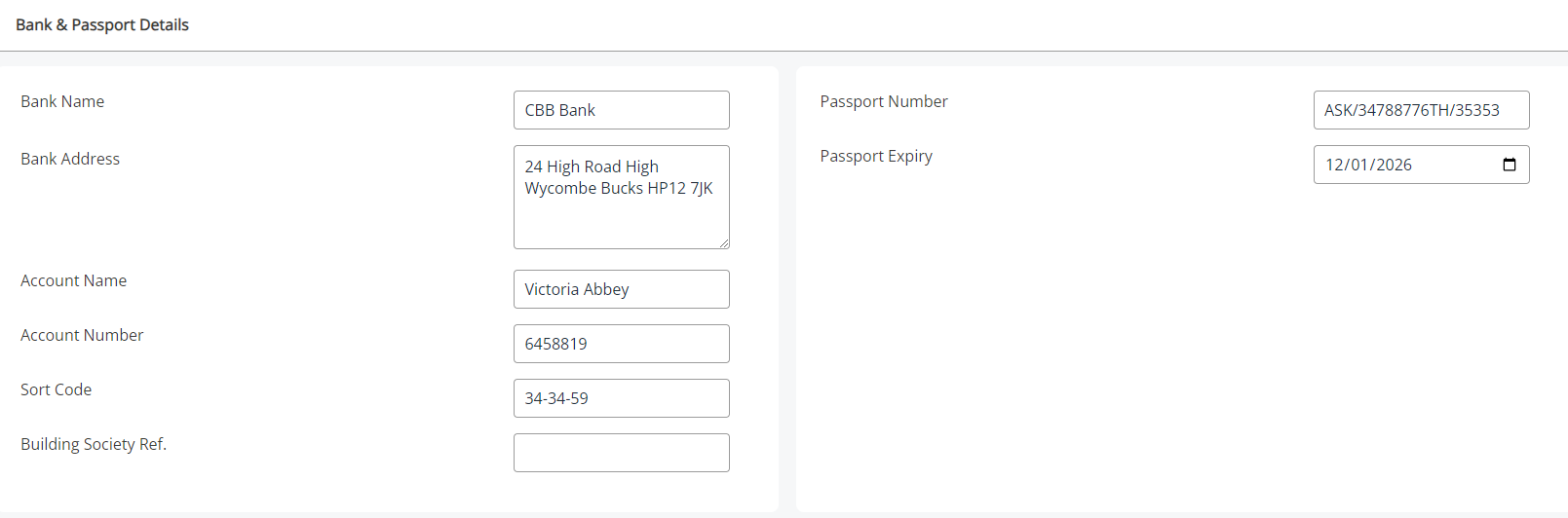

Bank and Passport Details

-

Use this section to update your bank and passport details.

You must have the necessary Set Rights Set Rights are the system permissions you allocate to employees to control the information available to a user about other employees. permissions to update your details, and the fields displayed may differ depending on your access levels. If you cannot update your information, contact your admin.

Documents

-

Use this section to view any documents your admin has uploaded for you.

Notes

-

Add notes (if you have permission) or view admin notes.

Payslip History

-

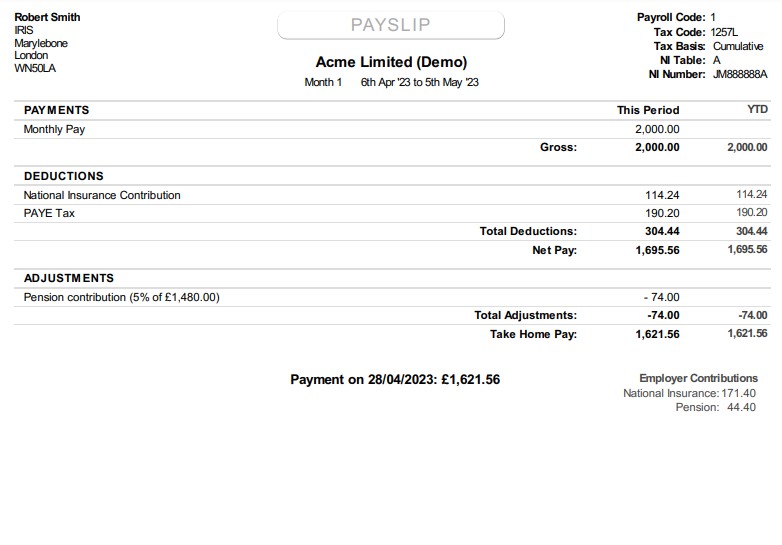

Here you can view your payslips.

Payslips only display for companies with payroll integrated and may look different depending on your company's payroll provider.

Personal Information

Your payslip includes personal details such as:

-

Name: Your full name.

-

Employee Number: A unique identifier assigned to you by your employer.

-

Tax Code: Indicates your tax-free personal allowance. Common codes include 1257L.

Payment Details

This section outlines your earnings, including:

-

Basic Pay: Your standard salary or hourly wage.

-

Overtime: Additional pay for hours worked beyond your regular schedule.

-

Bonuses and Commissions: Extra earnings based on performance or sales.

Deductions

Deductions reduce your gross pay to net pay, including:

-

Income Tax: Based on your tax code and earnings, paid to HMRC.

-

National Insurance (NI): Contributions to the National Insurance system.

-

Pension Contributions: Deductions for your workplace pension scheme.

-

Student Loan Repayments: If applicable, repayments towards your student loan.

-

Other Deductions: May include things like union fees or salary sacrifice schemes.

Net Pay

-

This is your take-home pay after deductions, which your employer will deposit into your bank account.

Employer Contributions

While not deducted from your pay, this section shows what your employer contributes, such as:

-

Employer Pension Contributions: Contributions made by your employer to your pension.

-

Employer NI Contributions: Contributions your employer makes to the National Insurance system.

Year-to-Date Totals

This section provides cumulative totals for the current tax year, including:

-

Total Earnings: The total amount you have earned so far this year.

-

Total Deductions: The total amount deducted from your pay this year.

-

Total Net Pay: The total take-home pay you have received this year.

P45/Starter Checklist

-

Find details for your P45/Starter Checklist here.

Copy P60

-

Select this tab to view your P60s.

-