Set up a pension benefit

A pension is a retirement fund for an employee which is paid into by the employer, employee, or both, with the employer usually covering the largest percentage of contributions. When the employee retires, they are paid in an annuity calculated by the terms of the pension.

In this section:

Assign a pension provider to an employee

-

Sign in to Staffology HR.

-

Go to Directories.

-

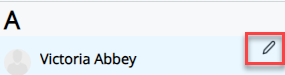

Select the required employee and choose Edit.

You can also select the edit icon displayed on the employee's name:

-

Select Benefits.

-

From the dropdown, choose Pension > Create New.

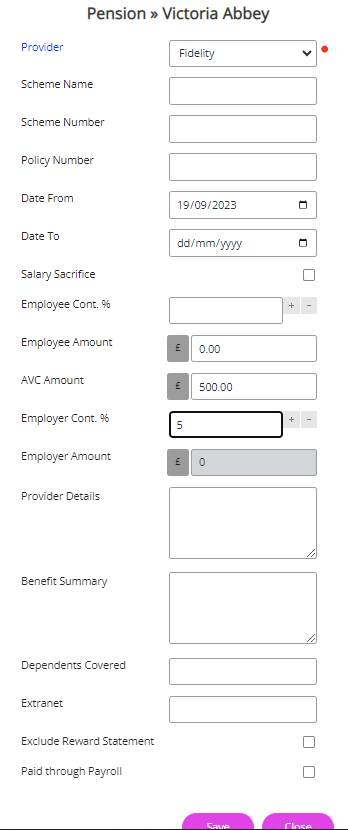

The Pension form opens.

The fields on this screen change when selecting the Salary Sacrifice Salary sacrifice is a financial arrangement where an employee agrees to give up a portion of their salary or wages in exchange for certain non-cash benefits provided by their employer. checkbox:

Fields and calculations for pension when Salary Sacrifice is deselected

| Provider |

The name of the Pension Provider.

If no options display in the dropdown, select Provider or go to System Tools > Lookup Tables > Benefits > Life Cover Provider to add your provider lookups.

|

| Scheme Name | Enter the scheme name. |

| Scheme Number | Enter the scheme number. |

| Policy Number | Enter the pension policy number. |

| Date From | Enter the pension start date. |

| Date To | Enter the pension end date. |

| Salary Sacrifice |

Leave this checkbox deselected if you do not want to deduct the pension amount from the employee's salary before they are paid.

|

| Employee Cont.% |

Either enter the percentage or the amount of salary the employee wants to put into their pension.

If you enter the percentage, you cannot edit the Employee Amount field.

|

| Employee Amount |

Either enter the percentage or the amount of salary the employee wants to put into their pension.

If you enter the amount, you cannot edit the Employee Cont % field.

|

|

AVC Amount (Additional voluntary contribution) |

Enter the amount of AVC the employee is to pay to top up their pension. |

| Employer Cont % |

Enter either the percentage or the amount of the employee's reference salary you as the employer want to pay into the employee's pension.

If you enter the percentage, you cannot edit the Employer Amount field.

|

| Employer Amount |

Enter either the percentage or the amount of the employee's reference salary you as the employer want to pay into the employee's pension.

If you enter the percentage, you cannot edit the Employer Cont % field.

|

| Provider Details | Enter additional information about the provider (e.g. address, primary contact etc). |

| Benefit Summary |

Refer to the Summary section in the Reward Statement for more details.

Go to Rewards in the left-hand navigation menu of your homepage to find the summary.

|

| Dependants Covered |

Complete if any dependants are included in the cover.

|

| Extranet | Add the provider's website. This displays via the reward statement and the employee can use this link to obtain further information about the provider. |

| Opt Out Date | Date of opting out. |

| Cease Membership Date | Date Membership ceased. |

| Exclude Reward Statement | Select this checkbox if you want to exclude this benefit from the reward statement. |

| Paid through Payroll | Select this checkbox if you want the pension deduction to be paid through payroll. |

| Actions | |

| Activity* | You can create an activity relating to this record. |

| Linked Documents | You can upload related documents that the employee can view. |

| Data Audit | Audit of any changes. |

| Mail Merge Field Selector | To create mail merge documents relating to this benefit. |

| Mail Merge | Merge the data from the record into the previously created mail merge document. |

| Reminder Alerts* | Frequency based reminders for this record. |

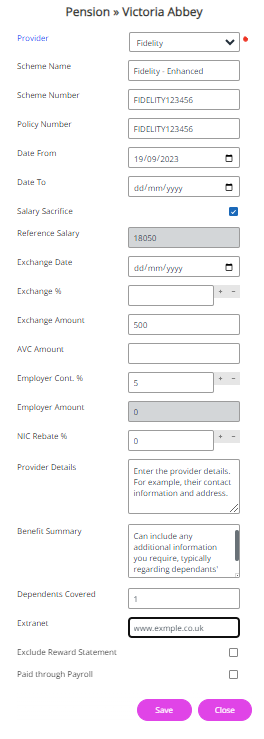

Fields shown with Salary Sacrifice selected

Fields and calculations for pension when Salary Sacrifice is selected

| Provider |

The name of the Pension Provider.

If no options display in the dropdown, select Provider or go to System Tools > Lookup Tables > Benefits > Life Cover Provider to add your provider lookups.

|

| Scheme Name | Enter the scheme name. |

| Scheme Number | Enter the scheme number. |

| Policy Number | Enter the pension policy number. |

| Date From | Enter the pension start date. |

| Date To | Enter the pension end date. |

| Salary Sacrifice |

Select this checkbox to deduct the amount from the employee's salary before they are paid.

|

| Reference Salary | You cannot edit the Reference Salary. The figure shown here is the basic salary shown in the employee's Payroll tab that the sacrifice is to deduct from. |

| Exchange Date | Enter the date the sacrifice began. |

| Exchange % |

Enter either the percentage or amount to deduct from the reference salary.

If you enter the percentage, you cannot edit the Exchange Amount field.

|

| Exchange Amount |

Enter either the percentage or amount to deduct from the reference salary.

If you enter the amount, you cannot edit the Exchange % field.

|

|

AVC Amount

(Additional voluntary contribution)

|

Enter the amount of AVC the employee is to pay to top up their pension. |

| Employer Cont % |

Enter either the percentage or the amount of the employee's reference salary you as the employer want to pay into the employee's pension.

If you enter the percentage, you cannot edit the Employer Amount field.

|

| Employer Amount |

Enter either the percentage or the amount of the employee's reference salary you as the employer want to pay into the employee's pension.

If you enter the percentage, you cannot edit the Employer Cont % field.

|

| NIC Rebate %

(National Insurance) |

Should you wish to pass on the NIC refund you have received due to the salary sacrifice on NI to the employee, enter the percentage you want to refund. |

| Provider Details | Enter additional information about the provider (e.g. address, primary contact etc). |

| Benefit Summary |

Refer to the Summary section in the Reward Statement for more details.

Go to Rewards in the left-hand navigation menu of your homepage to find the summary.

|

| Dependants Covered | Complete if any dependants are included in the cover. |

| Extranet | Add the provider's website. This displays via the reward statement and the employee can use this link to obtain further information about the provider. |

| Exclude Reward Statement | Select this checkbox if you want to exclude this benefit from the reward statement. |

| Paid through Payroll | Select this checkbox if you want the pension deduction to be paid through payroll. |

| Actions | |

| Activity* | You can create an activity relating to this record. |

| Linked Documents | You can upload related documents that the employee can view. |

| Data Audit | Audit of any changes. |

| Mail Merge Field Selector | To create mail merge documents relating to this benefit. |

| Mail Merge | Merge the data from the record into the previously created mail merge document. |

| Reminder Alerts* | Frequency based reminders for this record. |

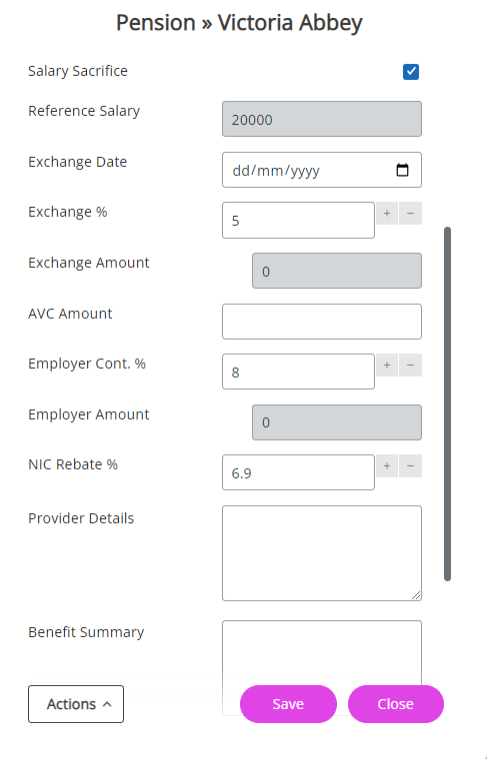

Pensions and Salary Sacrifice

Employees

Salary sacrifice means giving up part of your salary in return for a tax or National Insurance benefit. The benefit may be a pension contribution. If it is, the employer pays it directly into employees' pensions.

As salary sacrifices are deducted from the pre-tax salary, employees save income tax and National Insurance on the sacrificed amount.

For example, if an employee receives £20,000 per annum and £1,000 of this is sacrificed for pension contributions of 5%, they only pay National Insurance on the first £19,000 of their salary.

Employers

Employer savings relate to employer National Insurance rates.

Generally, employers contribute 13.8% to National Insurance and can therefore, generate up to 13.8% savings on any funds processed via salary sacrifice.

In addition, employers save on tax costs as there is no employer National Insurance contribution to pay on the portion of sacrificed salary.

Some employers share these savings with employees by paying them directly into the pension. The maximum they can pay is 13.8%.

In this example, they are sharing 50% of their saving with the employee:

| Gross Amounts | |

| Salary | £20,000 |

| Employee pension contribution 5% | £1000 |

| Employer pension contribution 8% | £1,600 |

| *Employer NI Saving 13.8% | £138.00 |

| * Employer NI savings given up is half of 13.8% |

£69.00 |

*Employer NI Savings given up equates to 6.9%

| Before Salary Sacrifice | After salary Sacrifice | |

| Salary | £20,000.00 | £19,000.00 |

| Adjusted personal allowance | £12,570.00 | £12,570.00 |

| Employee income tax | £1,286.00 | £1,286.00 |

| Employee NIC | £891.60 | £771.60 |

| Employer NIC | £1,504.20 | £1,366.20 |

| Net salary | £16,822.40 | £16,942.40 |

| Total pension contribution | £2,600.00 | £2,669.00 |

This would add in the employee's My Details > Benefits > Pension as follows:

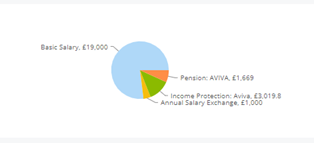

This also displays in the Reward Statement as follows:

-

Employee contribution of £1000 is shown as Annual Salary Exchange.

-

Pension: Employer’s contribution of £1669 includes 8% £1600 plus 6.9% NI refund of £69.00.

-

Total paid into employee’s pension of £2669.00.