Set up an Income Protection benefit

Income protection insurance is an insurance policy available in Australia, Ireland, New Zealand, South Africa, and the United Kingdom. This policy pays benefits to policyholders who are incapacitated and unable to work due to illness or accident. IPI policies were formally called Permanent Health Insurance.

To create an income protection benefit for an employee:

-

Sign in to Staffology HR.

-

Go to Directories.

-

Select the required employee and choose Edit.

You can also select the edit icon displayed on the employee's name:

-

Select Benefits.

-

From the dropdown, choose Income Protection > Create New.

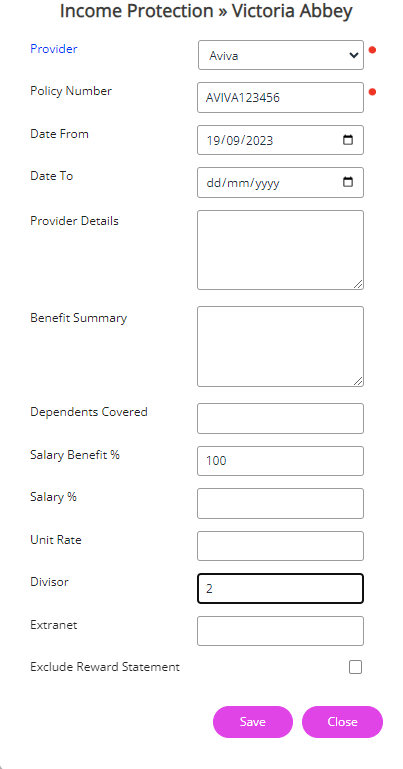

Fields for Income Protection

| Provider |

The name of the Income Protection provider.

If no options display in the dropdown, select Provider or go to System Tools > Lookup Tables > Benefits > Income Protection Provider to add your provider lookups.

|

| Policy Number | Enter the policy number. |

| Date to | Enter the policy start date. |

| Date from | Enter the policy end date. |

| Provider Details | Enter additional information about the provider (e.g. address, primary contact etc). |

| Benefit Summary | Enter additional information about the policy you require. This can include dependants' info or endorsements to the policy. |

| Salary Benefit % | The percentage of salary benefit appears in the Summary section. |

| Salary % | Refer to Calculations for Income Protection below. |

| Unit Rate | Refer to Calculations for Income Protection below. |

| Divisor | Refer to Calculations for Income Protection below. |

| Extranet | Add the provider's website. This displays via the reward statement and the employee can use this link to obtain further information about the provider. |

| Exclude Reward Statement | Select this checkbox if you want to exclude this policy from the reward statement. |

| Paid through Payroll | Select this checkbox if you want this policy to be paid through payroll. |

| Actions | |

| Activity* | You can create an activity relating to this record. |

| Linked Documents | If required, upload related documents for the employee to view. |

| Data Audit | Audit of any changes. |

| Mail Merge Field Selector | To create mail merge documents relating to this benefit. |

| Mail Merge | Merge the data from the record into the previously created mail merge document. |

| Reminder Alerts* | Frequency based reminders for this record. |

Calculations for Income Protection

-

You can use either Salary % or Unit Rate.

-

Salary % formula: Salary * (Percentage/100).

-

When using Unit Rate, you must also use the Divisor.

When calculating via the unit rate, income protection subtracts 4091.00 to handle Employment & Support Allowance (ESA) payments External website.

Formula for Income Protection

(((Salary – 4901) * Unit Rate) * Divisor) / 100.